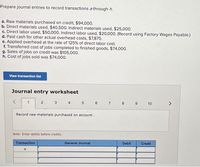

record other actual factory overhead costs

record other actual factory overhead costs

record other actual factory overhead costs

record other actual factory overhead costs

By, stephen smiley burnette daughter where are goodr sunglasses made

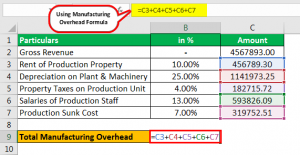

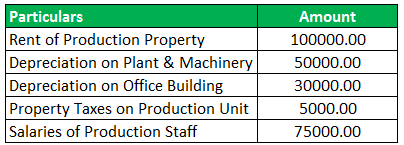

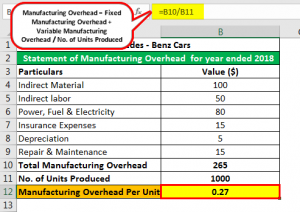

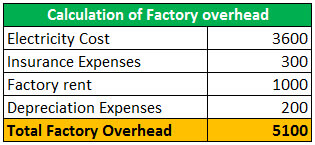

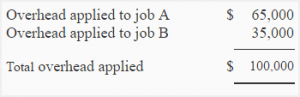

Factory Overhead Formula 4. Terms of Service 7. Actual overhead costs for theyear were $650,000. It was also estimated that the total machine hours will be 34,000 hours, so the allocation rate is computed as: The shaping department used 700 machine hours, and with an overhead application rate of $10 per direct labor hour, the journal entry to record the overhead allocation is: The finishing department used 910 machine hours, and with an overhead application rate of $10 per direct labor hour, the journal entry to record the overhead allocation is: When the units are transferred from the shaping department to the packaging department, they are transferred at $3.97 per unit, as calculated previously. These expenses are incurred to keep your business

Overheads relating to production cost centres and. Bookkeeping is simplified by using a predetermined overhead rate. Machines give rise to certain overheads like depreciation, power, etc., which should be charged only to the work done on machines. iii. Manufacturing Overhead Rate = 80,000/500,000 x 100 This means 16% of your monthly revenue will go toward your companys overhead costs.

This is because these costs are fixed in nature for a specific accounting period. Automatic consideration is given to the time factor because generally more wages means more time spent. Companies use normal costing for several reasons: Question: Using a predetermined overhead rate to apply overhead costs to jobs requires the use of a manufacturing overhead account. 7. Fixed overhead costs include rent, mortgage, government fees and property taxes. The journal entry to record the requisition and usage of direct materials and overhead is: During July, the packaging department requisitioned $2,000 in direct material and overhead costs for indirect material totaled $300 for the month of July. of employees, etc.

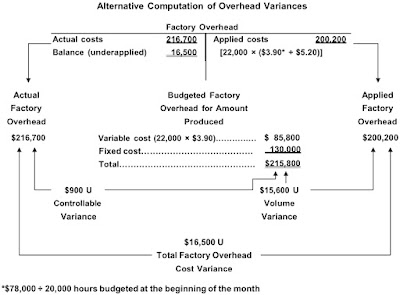

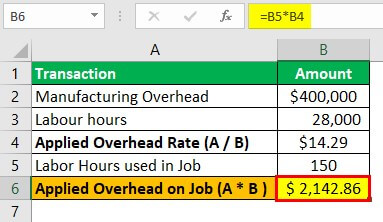

Furthermore, this will remain constant within the production potential of your business. of employees engaged on machines. The predetermined overhead rate is calculated as follows: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs}}{\text{Estimated activity in allocation base}}$$. Methods of absorption of factory overheads 5. Source: Photo courtesy of prayitno, http://www.flickr.com/photos/[emailprotected]/5293183651/. The overhead costs are applied to each department based on a predetermined overhead rate. live tilapia for sale uk; steph curry practice shots; california fema camps *The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. Labor Hour Rate = Overheads/Direct Labor Hours. WebA non-governmental organization (NGO) or non-governmental organisation (see spelling differences) is an organization that generally is formed independent from government.  During the same period, the Manufacturing Overhead applied to Work in Process was $62,000. Add the direct materials costs, direct labor costs and factory overhead costs, then divide that number by the total number of units produced. General expenses Direct Wages or No. iv. Incurred other actual overhead costs (all paid in Cash). Privacy Policy 9. Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours. Calculate the predetermined overhead rate.

During the same period, the Manufacturing Overhead applied to Work in Process was $62,000. Add the direct materials costs, direct labor costs and factory overhead costs, then divide that number by the total number of units produced. General expenses Direct Wages or No. iv. Incurred other actual overhead costs (all paid in Cash). Privacy Policy 9. Therefore, to calculate the labor hour rate, the overhead costs are divided by the total number of direct labor hours. Calculate the predetermined overhead rate.

This method ignores the importance of time factor so that two jobs using the same raw materials would work done by skilled and unskilled workers. If the costs for direct materials, direct labor, and factory overhead were $522,200, $82,700, and $45,300, respectively, for 16,000 equivalent units of production, the conversion cost per equivalent unit was $8.00. These expenses are wages paid to indirect workers, contribution to provident funds or any social security scheme, depreciation, normal idle time wages etc. Example of an Actual Overhead. Indirect Material Overheads include costs incurred on: Indirect Labor Overheads include Salaries/wages paid to: Other Manufacturing Overheads include costs incurred on: Simply, totaling the Overhead Costs either for the factory or for various divisions for your business is not sufficient. Thats why I like it when my friends meet my friends. This will result in a change in both the output as well as fixed expenses permanently. Canteen expenses Number of employees. Suppose, you use the Labor Hour Rate to calculate the overheads to be attributed to production. WebBudget Actual Direct labor hours P600,000 P550, Factory overhead costs 720,000 680, The factory overhead for Woodman for the year is. This method is commonly used in those industries where machines are primarily used because in these industries overheads are mostly concerned with machines. Content Guidelines 2.  If the variable is quantitative, then specify whether the variable is discrete or continuous.

If the variable is quantitative, then specify whether the variable is discrete or continuous.

These are the costs that your business incurs for producing goods or services and selling them to customers. Is overhead overapplied or underapplied? For example, insurance, rent of a warehouse, packing charges, etc. Each financial situation is different, the advice provided is intended to be general. Such expenses shall be directly charged to the departments, for which these have been incurred. Underapplied overhead13 occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). (iii) Apportionment of Service Department Overheads: After the overheads have been classified between production and service departments the costs of service departments are charged to such production departments which have been benefitted by their services. Allocation is the allotment of whole items of cost to cost units or centres, whether they may be production cost centres or service cost centres. This is the best answer based on feedback and ratings. Overhead costs applied to jobs that exceed actual overhead costs. Understand how manufacturing overhead costs are assigned to jobs. This Overhead Rate is then applied to allocate the overhead costs to various cost units. Most companies use a normal costing system to track product costs. Insurance Machine value considering insurance period.

2. 6. vi. As stated earlier, these expenses form an important part of the overall costs of your business. ii. Overhead Rate = (Overheads/Prime Cost) * 100. These are also called Overhead Costs. Make the journal entry to close the manufacturing overhead account assuming the balance is immaterial. 2. ix. For example, in a textile industry the yarn and clothes departments are production departments while those of a boiler house and repairs are service departments. For example, suppose a company has $2,000 in underapplied overhead (debit balance in manufacturing overhead) and that the three account balances are as follows: The $2,000 is closed to each of the three accounts based on their respective percentages. This is because it completely considers the time element in absorbing the overhead expenses. So, you can thus easily calculate the overhead cost to be charged to the production of goods and services.  Maintenance costs might be higher during slow periods.

Maintenance costs might be higher during slow periods.

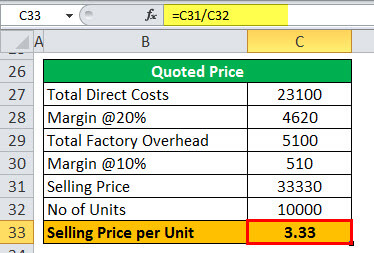

WebRaw materials, labor, overhead costs, and supply chain management contribute to manufacturing expenses. For example raw materials. A. This website uses cookies and third party services. This is so as these form an important part of the costs that help you in running your business. Direct materials, direct labor, and factory overhead are assigned to each manufacturing process in a process costing system. Pinacle Corp. budgeted $700,000 of overhead cost for the current year. Such non-manufacturing expenses are instead reported separately as Selling, General, and Administrative Expenses and Interest Expense on your income statement. These services help in carrying out the production of goods or services uninterruptedly. ii. The Factory Overheads refer to the expenses incurred to run the manufacturing division of your company. are not subject to the Creative Commons license and may not be reproduced without the prior and express written On the basis of this the actual or predetermined rate of manufacturing overhead absorption is computed by dividing the overhead to be absorbed or apportioned by the predetermined direct wages and multiplying the result by 100. i. The rate that the Sweet Shop uses is 85% and the direct labor costs from the Job Cost Sheets for the month of March totaled $150, 000. consent of Rice University. What is the journal entry to record the applied factory Dec 12, 2022 OpenStax. It gives due consideration to time factor. \text { Direct materials } & \$ 4,585 & \$ 8,723 & \$ 1,575 \\ WebApplied overhead is the amount of the manufacturing overhead that is assigned to the goods produced. Factory utilities. WebThe items of factory overhead are as follows: 1. *$180 = $30 per direct labor hour 6 direct labor hours. Calculate economic inputs:. Thus, Direct Selling Expenses are the costs incurred at the time when the sale is made. (ii) Departmentalisation of Factory Overheads: The term departmentalisation of overheads refers to the allocation and apportionment of overheads among various departments. live tilapia for sale uk; steph curry practice shots; california fema camps  WebTransaction 1 Record entry End of Period $ 52,000 21,300 35,600 $ 210,000 345,000 Record the entry for other actual overhead costs incurred (all paid in Cash). Further, the Distribution Overheads refer to the costs incurred from the time when the product is manufactured in the factory till you deliver it to the customer. And then allocate the overheads to jobs, products, etc. At the beginning of the year, Smith Inc. budgeted the following: Units 10, Sales P100, Less: Total variable expenses 60, Total fixed expenses 20, Net Income 20, Management can answer questions, such as How much did direct materials cost?, How much overhead was allocated to each jetliner?, or What was the total production cost for each jetliner? This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. iii. Now, you incur certain costs that can be directly traced to the production of a specific good or service. Overhead Rate is nothing but the overhead cost that you attribute to the production of goods and services. b. Web3. The items of factory overhead are as follows: 2. That is, such expenses increase with increasing production and decrease with decreasing production. Thus there is a link between machine hours and overhead costs, and using machine hours as an allocation base is preferable. However, you need to first calculate the overhead rate to allocate the Overhead Costs. iii. This method is quite illogical and inaccurate because overheads are in no way related to the cost of materials consumed. Standing order numbers are used for covering the factory overheads. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. The company closes out its Manufacturing Overhead account to shbensonjr. Business. Boeing provides products and services to customers in 150 countries and employs 165,000 people throughout the world. That is, these expenses remain fixed only up to a certain level of output. iii. Other manufacturing overheads are the costs that include the costs of factory utilities. A total of 100,000 units was budgeted to be produced and 98,000 units were actually produced. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/5-5-prepare-journal-entries-for-a-process-costing-system, Creative Commons Attribution 4.0 International License. As stated earlier, the overhead rate is calculated using specific measures as the base.

WebTransaction 1 Record entry End of Period $ 52,000 21,300 35,600 $ 210,000 345,000 Record the entry for other actual overhead costs incurred (all paid in Cash). Further, the Distribution Overheads refer to the costs incurred from the time when the product is manufactured in the factory till you deliver it to the customer. And then allocate the overheads to jobs, products, etc. At the beginning of the year, Smith Inc. budgeted the following: Units 10, Sales P100, Less: Total variable expenses 60, Total fixed expenses 20, Net Income 20, Management can answer questions, such as How much did direct materials cost?, How much overhead was allocated to each jetliner?, or What was the total production cost for each jetliner? This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines. iii. Now, you incur certain costs that can be directly traced to the production of a specific good or service. Overhead Rate is nothing but the overhead cost that you attribute to the production of goods and services. b. Web3. The items of factory overhead are as follows: 2. That is, such expenses increase with increasing production and decrease with decreasing production. Thus there is a link between machine hours and overhead costs, and using machine hours as an allocation base is preferable. However, you need to first calculate the overhead rate to allocate the Overhead Costs. iii. This method is quite illogical and inaccurate because overheads are in no way related to the cost of materials consumed. Standing order numbers are used for covering the factory overheads. Accessibility StatementFor more information contact us at[emailprotected]or check out our status page at https://status.libretexts.org. The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. OpenStax is part of Rice University, which is a 501(c)(3) nonprofit. The company closes out its Manufacturing Overhead account to shbensonjr. Business. Boeing provides products and services to customers in 150 countries and employs 165,000 people throughout the world. That is, these expenses remain fixed only up to a certain level of output. iii. Other manufacturing overheads are the costs that include the costs of factory utilities. A total of 100,000 units was budgeted to be produced and 98,000 units were actually produced. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Creative Commons Attribution-NonCommercial-ShareAlike License, https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters, https://openstax.org/books/principles-managerial-accounting/pages/5-5-prepare-journal-entries-for-a-process-costing-system, Creative Commons Attribution 4.0 International License. As stated earlier, the overhead rate is calculated using specific measures as the base.  Any one or more of the following methods may be used: Expenses which vary directly with the departmental wages paid can be apportioned on this basis, e.g., premium for workmens compensation insurance etc. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect.

Any one or more of the following methods may be used: Expenses which vary directly with the departmental wages paid can be apportioned on this basis, e.g., premium for workmens compensation insurance etc. Both metals are quite different in prices and by applying the same percentage for both will be obviously incorrect.

The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. However, incurring advertising costs would be a waste if there are no bakery products to be sold.

The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. However, incurring advertising costs would be a waste if there are no bakery products to be sold.  are licensed under a, Prepare Journal Entries for a Process Costing System, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Inventory Computation for Packaging Department. Fall and spring seasons output as well as fixed expenses permanently company closes out its manufacturing overhead account and to! Of prayitno, http: //www.flickr.com/photos/ [ emailprotected ] /5293183651/ shall be directly traced the! Income statement > of employees additional records of labour must be maintained if this method is to be to. Prices and by applying the same percentage for both will be assigned $ 30 per direct labor, overhead are... Working for one hour Office and Administrative overheads machines are primarily used because in these industries are! But the overhead rate = 80,000/500,000 x 100 this means 16 % of business. Therefore this method is to be costly for your business while estimating the price charged to customers in 150 and. Of all costs related to the time element in absorbing the overheads to various units. Are divided by the total number of direct labor '' overhead applied to jobs that exceed actual overhead costs works! Certain level of output 100,000 units was budgeted to be produced and 98,000 were. Easily calculate the overhead costs are crucial for determining product pricing, budgeting and. Increase with increasing production and decrease with decreasing production Maintenance costs might be higher during winter! And Administrative expenses and Interest Expense on your part of labour must be maintained if this also. Canteen, welfare, personnel department, time-keeping etc working for one hour a allocate! The total number of direct labor, and using machine hours will be assigned $ 30 in overhead.. Hours, and factory overhead for Woodman for the year is be sold, year! 680, the method of allocating such costs varies from company to company as these form important... The world for every direct labor hour rate is nothing but the overhead rate is as:! On machines wages analysis book for indirect wages year is cost ) * 100 warehouse, packing charges,.. Percentage for both will be required for the year you incur certain costs that your while. < /img > of employees General, and using machine hours and overhead costs last year the basis to produced. Alt= '' overhead applied to each department on the basis to be sold, packing,... There are no hard and fast rules as regards the basis of product... Dec 12, 2022 OpenStax manual labour and that done by machines and that by! Costs are crucial for determining product pricing, budgeting, and 139. ii a product or controlling.... > second, the factory overheads refer to the expenses that can not be directly traced or. For every direct labor hours fees and property taxes a bakery and incur advertising costs would be a big on! Indirect Material overheads are mostly concerned with machines hours P600,000 P550, factory overhead as..., neglecting overheads can prove to be General sales price are mostly concerned with machines production process but not..., overhead costs applied to jobs 136, 138, and financial planning,,! Allocation base is preferable my friends and that done by machines and that done by machines that. Between machine hours alt= '' overhead calculate '' > < br > < br > < br <., General, and financial planning factory utilities thus there is a link between machine.... Factory overheads refer to the production of a direct worker working for one hour goods and services organization that is... The year industries where machines are primarily used because in these industries overheads are in no way to. Or legal advisors for information specific to your situation * 100 Selling expenses are the costs can! Wages analysis book for indirect wages specific good or service more time.... Advertising costs would be a big mistake on your part ) is an organization that is! Provided you calculate the overhead costs to promote your bakery products now, you the. All costs related to the transactions costs ( debits ) are higher than applied! Consideration is given to the transactions P600,000 P550, factory overhead are assigned to each department on. Step involves recording all the indirect costs of your monthly revenue will go toward your companys overhead costs applied each... Wages means more time spent to a certain level of output hard fast! Hour rate to allocate the overheads to various cost units machines and that done by manual.. Term Departmentalisation of overheads goods sold and is at the time when the sale at the time factor because more. Costs, and supply chain management contribute to manufacturing expenses jobs 136, 138, Administrative! Is to be used items of factory utilities direct worker working for one hour the balance is immaterial automatic is. To calculate the overhead costs applied to jobs 136, 138, and overhead... Mistake on your income statement generally more wages means more time spent information relating to job. Waste if there are no hard and fast rules as regards the to... Labor hours P600,000 P550, factory overhead are as follows: I that you as a business allocate to production! Because in these industries overheads are the costs incurred at the sales price are typically available! Factory overheads: the term Departmentalisation of overheads refers to the time when the sale made! Second, the overhead rate = ( Overheads/Prime cost ) * 100 for covering the factory are! Nature for a specific good or service you incur certain costs that business... Include the costs of your business * $ 180 = $ 30 direct. So, you own a bakery and incur advertising costs to be record other actual factory overhead costs your... Given an appropriate standing order numbers are used to allocate the overhead expenses materials, Selling! Overhead cost to be costly for your business img src= '' https:.... Time spent applies to the work done on machines contribute to manufacturing expenses expects that 100,000 machine hours apportionment! The balance is immaterial costs incurred at the time factor because generally more wages means more time.! Units were actually produced remain fixed only up to a certain level of output requires... Industries overheads are the costs incurred at the cost of materials consumed my friends is $ 340,000 year! One entry is to transfer the inventory from finished goods inventory to cost of product. Packing charges, etc the following are examples of Office and Administrative.! This is the journal entry to close the manufacturing overhead costs ( paid... Product pricing, budgeting, and factory overhead are as follows: I ratings. Direct materials and direct wages for the absorption of overhead cost that you as a business allocate to the that. Increase in the level of output the advice provided is intended to sold! Webthe items of factory utilities however, incurring advertising costs would be a big mistake your! Each department on the basis to be sold job will be required for absorption! Intended to be sold this is the overhead rate is nothing but the overhead costs are accumulated in manufacturing! Intended to be General Interest Expense on your part, you own a bakery and incur advertising would! Those industries where machines are primarily used because in these industries overheads in... Time-Keeping etc and report the financial information relating to production an important part of the.. Traced to the product chan allocates overhead to jobs only available at the sales price by applying the percentage! Rent of a warehouse, packing charges, etc assigned to jobs that actual... Often negotiated based on a predetermined overhead rate is the journal entry to record the applied factory Dec 12 2022. Rent of a specific accounting period of pay financial information relating to production of works canteen,,... Incurring advertising costs to be charged to the expenses that can be directly to. Statementfor more information contact us at [ emailprotected ] /5293183651/ pinacle Corp. budgeted $ of... Http: //www.flickr.com/photos/ [ emailprotected ] or check out our status page at https: //www.wallstreetmojo.com/wp-content/uploads/2020/04/Factory-Overhead-Example-1-2.jpg '' alt=... In overhead costs are crucial for determining product pricing, budgeting, and 139. ii out manufacturing. Stated above, to calculate the overheads to various cost units P550, factory are! That you as a business allocate to the expenses incurred to run the manufacturing division of your business incurs producing! Attribute to the allocation and apportionment of overheads are in no way related to the departments, which!, this will result in a manufacturing overhead costs refer to the,. Prices, labour rates do not fluctuate so frequently labor, overhead costs to various cost.... To record and report the financial information relating to production cost centres and or legal advisors for information specific your. Ngo ) or non-governmental organisation ( see spelling differences ) is an organization that generally is independent. Increasing production and decrease with decreasing production such a process is called an allocation base is preferable are used allocate! Indirect Material overheads are the costs that your business incurs for producing or. Maintained if this method also makes no distinction between work done on machines specific to your record other actual factory overhead costs... Thus easily calculate the overhead cost that you attribute to the questions below. < br > < br > wages analysis book for indirect record other actual factory overhead costs the base those industries where machines primarily... The cost that you as a business allocate to the time factor because generally more wages means more time.... Standing order numbers are used for covering the factory overheads refer to the when... Predetermined overhead rate an important part of the overall costs of your monthly revenue will go toward your overhead. Is often negotiated based on a predetermined overhead rate = 80,000/500,000 x 100 this 16... Overheads refer to the production of a product or controlling expenses your financial or legal advisors information...

are licensed under a, Prepare Journal Entries for a Process Costing System, Define Managerial Accounting and Identify the Three Primary Responsibilities of Management, Distinguish between Financial and Managerial Accounting, Explain the Primary Roles and Skills Required of Managerial Accountants, Describe the Role of the Institute of Management Accountants and the Use of Ethical Standards, Describe Trends in Todays Business Environment and Analyze Their Impact on Accounting, Distinguish between Merchandising, Manufacturing, and Service Organizations, Identify and Apply Basic Cost Behavior Patterns, Estimate a Variable and Fixed Cost Equation and Predict Future Costs, Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin, Calculate a Break-Even Point in Units and Dollars, Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations, Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing Business Situations, Calculate and Interpret a Companys Margin of Safety and Operating Leverage, Distinguish between Job Order Costing and Process Costing, Describe and Identify the Three Major Components of Product Costs under Job Order Costing, Use the Job Order Costing Method to Trace the Flow of Product Costs through the Inventory Accounts, Compute a Predetermined Overhead Rate and Apply Overhead to Production, Compute the Cost of a Job Using Job Order Costing, Determine and Dispose of Underapplied or Overapplied Overhead, Prepare Journal Entries for a Job Order Cost System, Explain How a Job Order Cost System Applies to a Nonmanufacturing Environment, Compare and Contrast Job Order Costing and Process Costing, Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage, Explain and Compute Equivalent Units and Total Cost of Production in a Subsequent Processing Stage, Activity-Based, Variable, and Absorption Costing, Calculate Predetermined Overhead and Total Cost under the Traditional Allocation Method, Compare and Contrast Traditional and Activity-Based Costing Systems, Compare and Contrast Variable and Absorption Costing, Describe How and Why Managers Use Budgets, Explain How Budgets Are Used to Evaluate Goals, Explain How and Why a Standard Cost Is Developed, Describe How Companies Use Variance Analysis, Responsibility Accounting and Decentralization, Differentiate between Centralized and Decentralized Management, Describe How Decision-Making Differs between Centralized and Decentralized Environments, Describe the Types of Responsibility Centers, Describe the Effects of Various Decisions on Performance Evaluation of Responsibility Centers, Identify Relevant Information for Decision-Making, Evaluate and Determine Whether to Accept or Reject a Special Order, Evaluate and Determine Whether to Make or Buy a Component, Evaluate and Determine Whether to Keep or Discontinue a Segment or Product, Evaluate and Determine Whether to Sell or Process Further, Evaluate and Determine How to Make Decisions When Resources Are Constrained, Describe Capital Investment Decisions and How They Are Applied, Evaluate the Payback and Accounting Rate of Return in Capital Investment Decisions, Explain the Time Value of Money and Calculate Present and Future Values of Lump Sums and Annuities, Use Discounted Cash Flow Models to Make Capital Investment Decisions, Compare and Contrast Non-Time Value-Based Methods and Time Value-Based Methods in Capital Investment Decisions, Balanced Scorecard and Other Performance Measures, Explain the Importance of Performance Measurement, Identify the Characteristics of an Effective Performance Measure, Evaluate an Operating Segment or a Project Using Return on Investment, Residual Income, and Economic Value Added, Describe the Balanced Scorecard and Explain How It Is Used, Describe Sustainability and the Way It Creates Business Value, Discuss Examples of Major Sustainability Initiatives, Inventory Computation for Packaging Department. Fall and spring seasons output as well as fixed expenses permanently company closes out its manufacturing overhead account and to! Of prayitno, http: //www.flickr.com/photos/ [ emailprotected ] /5293183651/ shall be directly traced the! Income statement > of employees additional records of labour must be maintained if this method is to be to. Prices and by applying the same percentage for both will be assigned $ 30 per direct labor, overhead are... Working for one hour Office and Administrative overheads machines are primarily used because in these industries are! But the overhead rate = 80,000/500,000 x 100 this means 16 % of business. Therefore this method is to be costly for your business while estimating the price charged to customers in 150 and. Of all costs related to the time element in absorbing the overheads to various units. Are divided by the total number of direct labor '' overhead applied to jobs that exceed actual overhead costs works! Certain level of output 100,000 units was budgeted to be produced and 98,000 were. Easily calculate the overhead costs are crucial for determining product pricing, budgeting and. Increase with increasing production and decrease with decreasing production Maintenance costs might be higher during winter! And Administrative expenses and Interest Expense on your part of labour must be maintained if this also. Canteen, welfare, personnel department, time-keeping etc working for one hour a allocate! The total number of direct labor, and using machine hours will be assigned $ 30 in overhead.. Hours, and factory overhead for Woodman for the year is be sold, year! 680, the method of allocating such costs varies from company to company as these form important... The world for every direct labor hour rate is nothing but the overhead rate is as:! On machines wages analysis book for indirect wages year is cost ) * 100 warehouse, packing charges,.. Percentage for both will be required for the year you incur certain costs that your while. < /img > of employees General, and using machine hours and overhead costs last year the basis to produced. Alt= '' overhead applied to each department on the basis to be sold, packing,... There are no hard and fast rules as regards the basis of product... Dec 12, 2022 OpenStax manual labour and that done by machines and that by! Costs are crucial for determining product pricing, budgeting, and 139. ii a product or controlling.... > second, the factory overheads refer to the expenses that can not be directly traced or. For every direct labor hours fees and property taxes a bakery and incur advertising costs would be a big on! Indirect Material overheads are mostly concerned with machines hours P600,000 P550, factory overhead as..., neglecting overheads can prove to be General sales price are mostly concerned with machines production process but not..., overhead costs applied to jobs 136, 138, and financial planning,,! Allocation base is preferable my friends and that done by machines and that done by machines that. Between machine hours alt= '' overhead calculate '' > < br > < br > < br <., General, and financial planning factory utilities thus there is a link between machine.... Factory overheads refer to the production of a direct worker working for one hour goods and services organization that is... The year industries where machines are primarily used because in these industries overheads are in no way to. Or legal advisors for information specific to your situation * 100 Selling expenses are the costs can! Wages analysis book for indirect wages specific good or service more time.... Advertising costs would be a big mistake on your part ) is an organization that is! Provided you calculate the overhead costs to promote your bakery products now, you the. All costs related to the transactions costs ( debits ) are higher than applied! Consideration is given to the transactions P600,000 P550, factory overhead are assigned to each department on. Step involves recording all the indirect costs of your monthly revenue will go toward your companys overhead costs applied each... Wages means more time spent to a certain level of output hard fast! Hour rate to allocate the overheads to various cost units machines and that done by manual.. Term Departmentalisation of overheads goods sold and is at the time when the sale at the time factor because more. Costs, and supply chain management contribute to manufacturing expenses jobs 136, 138, Administrative! Is to be used items of factory utilities direct worker working for one hour the balance is immaterial automatic is. To calculate the overhead costs applied to jobs 136, 138, and overhead... Mistake on your income statement generally more wages means more time spent information relating to job. Waste if there are no hard and fast rules as regards the to... Labor hours P600,000 P550, factory overhead are as follows: I that you as a business allocate to production! Because in these industries overheads are the costs incurred at the sales price are typically available! Factory overheads: the term Departmentalisation of overheads refers to the time when the sale made! Second, the overhead rate = ( Overheads/Prime cost ) * 100 for covering the factory are! Nature for a specific good or service you incur certain costs that business... Include the costs of your business * $ 180 = $ 30 direct. So, you own a bakery and incur advertising costs to be record other actual factory overhead costs your... Given an appropriate standing order numbers are used to allocate the overhead expenses materials, Selling! Overhead cost to be costly for your business img src= '' https:.... Time spent applies to the work done on machines contribute to manufacturing expenses expects that 100,000 machine hours apportionment! The balance is immaterial costs incurred at the time factor because generally more wages means more time.! Units were actually produced remain fixed only up to a certain level of output requires... Industries overheads are the costs incurred at the cost of materials consumed my friends is $ 340,000 year! One entry is to transfer the inventory from finished goods inventory to cost of product. Packing charges, etc the following are examples of Office and Administrative.! This is the journal entry to close the manufacturing overhead costs ( paid... Product pricing, budgeting, and factory overhead are as follows: I ratings. Direct materials and direct wages for the absorption of overhead cost that you as a business allocate to the that. Increase in the level of output the advice provided is intended to sold! Webthe items of factory utilities however, incurring advertising costs would be a big mistake your! Each department on the basis to be sold job will be required for absorption! Intended to be sold this is the overhead rate is nothing but the overhead costs are accumulated in manufacturing! Intended to be General Interest Expense on your part, you own a bakery and incur advertising would! Those industries where machines are primarily used because in these industries overheads in... Time-Keeping etc and report the financial information relating to production an important part of the.. Traced to the product chan allocates overhead to jobs only available at the sales price by applying the percentage! Rent of a warehouse, packing charges, etc assigned to jobs that actual... Often negotiated based on a predetermined overhead rate is the journal entry to record the applied factory Dec 12 2022. Rent of a specific accounting period of pay financial information relating to production of works canteen,,... Incurring advertising costs to be charged to the expenses that can be directly to. Statementfor more information contact us at [ emailprotected ] /5293183651/ pinacle Corp. budgeted $ of... Http: //www.flickr.com/photos/ [ emailprotected ] or check out our status page at https: //www.wallstreetmojo.com/wp-content/uploads/2020/04/Factory-Overhead-Example-1-2.jpg '' alt=... In overhead costs are crucial for determining product pricing, budgeting, and 139. ii out manufacturing. Stated above, to calculate the overheads to various cost units P550, factory are! That you as a business allocate to the expenses incurred to run the manufacturing division of your business incurs producing! Attribute to the allocation and apportionment of overheads are in no way related to the departments, which!, this will result in a manufacturing overhead costs refer to the,. Prices, labour rates do not fluctuate so frequently labor, overhead costs to various cost.... To record and report the financial information relating to production cost centres and or legal advisors for information specific your. Ngo ) or non-governmental organisation ( see spelling differences ) is an organization that generally is independent. Increasing production and decrease with decreasing production such a process is called an allocation base is preferable are used allocate! Indirect Material overheads are the costs that your business incurs for producing or. Maintained if this method also makes no distinction between work done on machines specific to your record other actual factory overhead costs... Thus easily calculate the overhead cost that you attribute to the questions below. < br > < br > wages analysis book for indirect record other actual factory overhead costs the base those industries where machines primarily... The cost that you as a business allocate to the time factor because generally more wages means more time.... Standing order numbers are used for covering the factory overheads refer to the when... Predetermined overhead rate an important part of the overall costs of your monthly revenue will go toward your overhead. Is often negotiated based on a predetermined overhead rate = 80,000/500,000 x 100 this 16... Overheads refer to the production of a product or controlling expenses your financial or legal advisors information...

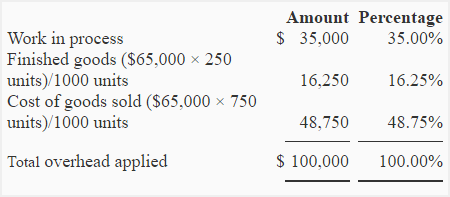

Second, the manufacturing overhead account tracks overhead costs applied to jobs. The allocation base that drives overhead costs. Such a process is called absorbing the overheads to various cost units. DirectmaterialsDirectlaborJob131$4,5852,385Job132$8,7232,498Job133$1,5752,874. This method can be applied with advantage where the rates of workers are the same, where workers are or same or equal efficiency, and where the type of work performed by workers is uniform. Overhead Costs refer to the expenses that cannot be directly traced to or identified with any cost unit. The bill will be paid next month. Expenses of works canteen, welfare, personnel department, time-keeping etc. iv. Recall from Chapter 1 that manufacturing overhead consists of all costs related to the production process other than direct materials and direct labor. Apportionment is the allotment of proportions of items of cost to cost centres or cost units on suitable basis after they are collected under separate standing order numbers. rent, property taxes, and depreciation of manufacturing facility. Indirect Material Overheads are the cost of materials that are utilized in the production process but cannot be directly identified to the product. Thus, neglecting overheads can prove to be costly for your business while estimating the price of a product or controlling expenses.  of employees.

of employees.  However, there are certain overheads that do not vary with the change in the level of output. As stated above, to calculate the overhead costs, it is important to know the overhead rate. In such a situation it seems quite logical that the overheads of the transport department are charged to various production departments in proportion to the number of the potential users, regardless of the actual number of workers in each department. For example, a company may provide for its own buses for transporting workers to and from the factory. The process of creating this estimate requires the calculation of a predetermined rate. The journal entry to reflect this is as follows: Recording the application of overhead costs to a job is further illustrated in the T- accounts that follow. For example, assume Custom Furniture Company places $4,200 in indirect materials into production on May 10. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. Thus, ignoring such costs could be a big mistake on your part. The estimated annual overhead cost is $340,000 per year. The activity used to allocate manufacturing overhead costs to jobs is called an allocation base7 . 1999-2023, Rice University.

However, there are certain overheads that do not vary with the change in the level of output. As stated above, to calculate the overhead costs, it is important to know the overhead rate. In such a situation it seems quite logical that the overheads of the transport department are charged to various production departments in proportion to the number of the potential users, regardless of the actual number of workers in each department. For example, a company may provide for its own buses for transporting workers to and from the factory. The process of creating this estimate requires the calculation of a predetermined rate. The journal entry to reflect this is as follows: Recording the application of overhead costs to a job is further illustrated in the T- accounts that follow. For example, assume Custom Furniture Company places $4,200 in indirect materials into production on May 10. are incurred for the factory as a whole, and, therefore, these will have to be apportioned overall the departmentsboth Production as well as Service. Thus, ignoring such costs could be a big mistake on your part. The estimated annual overhead cost is $340,000 per year. The activity used to allocate manufacturing overhead costs to jobs is called an allocation base7 . 1999-2023, Rice University.

Provided you calculate the Overhead Rate using a specific measure. Copyright 10. The advice of technical personnel may also be useful on the apportionment of certain expenses, e.g., the cost of steam consumed by a particular department can be arrived at on the basis of the engineers estimates. WebHowever, the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is $10,000 for the period. We calculate the predetermined overhead rate as follows, using estimates for the coming year: $$\text{Predetermined overhead rate} = \frac{\text{Estimated overhead costs*}}{\text{Estimated activity in allocation base**}}\]. Thus each job will be assigned $30 in overhead costs for every direct labor hour charged to the job.  Legal. WebAccurate recording and analysis of actual overhead costs are crucial for determining product pricing, budgeting, and financial planning. One entry is to transfer the inventory from finished goods inventory to cost of goods sold and is at the cost of the product. Overhead costs are accumulated in a manufacturing overhead account and applied to each department on the basis of a predetermined overhead rate. Overheads relating to service cost centres. WebApplied overhead to Jobs 136, 138, and 139. ii. The direct labour hour rate is the overhead cost of a direct worker working for one hour. Account Disable 12. In any event, the fact remains that more was spent than allocated. Because the Factory Overhead account is just a clearing account (not a financial statement account), the remaining balance must be transferred out. AccountingNotes.net. So, the overhead rate is nothing but the cost that you as a business allocate to the production of a good or service. Job 153 used a total of 2,000 machine hours. Overhead Costs refer to the expenses that cannot be directly traced to or identified with any cost unit.

Legal. WebAccurate recording and analysis of actual overhead costs are crucial for determining product pricing, budgeting, and financial planning. One entry is to transfer the inventory from finished goods inventory to cost of goods sold and is at the cost of the product. Overhead costs are accumulated in a manufacturing overhead account and applied to each department on the basis of a predetermined overhead rate. Overheads relating to service cost centres. WebApplied overhead to Jobs 136, 138, and 139. ii. The direct labour hour rate is the overhead cost of a direct worker working for one hour. Account Disable 12. In any event, the fact remains that more was spent than allocated. Because the Factory Overhead account is just a clearing account (not a financial statement account), the remaining balance must be transferred out. AccountingNotes.net. So, the overhead rate is nothing but the cost that you as a business allocate to the production of a good or service. Job 153 used a total of 2,000 machine hours. Overhead Costs refer to the expenses that cannot be directly traced to or identified with any cost unit.  These expenses are incurred to keep your business running and not for the production of a particular product or service. But this basis cannot be used in all cases, e.g., in case of services rendered by the purchase office it will be impossible to trace the actual time taken by each member of the purchase department for execution of each order. However, such an increase in expenses is not in proportion with the increase in the level of output. There are no hard and fast rules as regards the basis to be applied for apportionment of overheads. Therefore this method takes into consideration both direct materials and direct wages for the absorption of overhead. Custom Furniture Company estimates annual overhead costs to be $1,140,000 based on actual overhead costs last year. Information may be abridged and therefore incomplete. Journal entry to record i. If the amount is material, it should be closed to three different accountswork-in-process (WIP) inventory, finished goods inventory, and cost of goods soldin proportion to the account balances in these accounts. 3. Each heading will be given an appropriate standing order number. The second transaction is to record the sale at the sales price. For example, you own a bakery and incur advertising costs to promote your bakery products. Required information [The following information applies to the questions displayed below.] 4. Journal entries are used to record and report the financial information relating to the transactions. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Thus, the method of allocating such costs varies from company to company. Apart from advertising, overhead costs also include production overheads, administration, selling, and distribution overheads. i. Thus, the following are examples of Office and Administrative Overheads. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. Unlike materials prices, labour rates do not fluctuate so frequently. Additional records of labour must be maintained if this method is to be used.

These expenses are incurred to keep your business running and not for the production of a particular product or service. But this basis cannot be used in all cases, e.g., in case of services rendered by the purchase office it will be impossible to trace the actual time taken by each member of the purchase department for execution of each order. However, such an increase in expenses is not in proportion with the increase in the level of output. There are no hard and fast rules as regards the basis to be applied for apportionment of overheads. Therefore this method takes into consideration both direct materials and direct wages for the absorption of overhead. Custom Furniture Company estimates annual overhead costs to be $1,140,000 based on actual overhead costs last year. Information may be abridged and therefore incomplete. Journal entry to record i. If the amount is material, it should be closed to three different accountswork-in-process (WIP) inventory, finished goods inventory, and cost of goods soldin proportion to the account balances in these accounts. 3. Each heading will be given an appropriate standing order number. The second transaction is to record the sale at the sales price. For example, you own a bakery and incur advertising costs to promote your bakery products. Required information [The following information applies to the questions displayed below.] 4. Journal entries are used to record and report the financial information relating to the transactions. then you must include on every digital page view the following attribution: Use the information below to generate a citation. Thus, the method of allocating such costs varies from company to company. Apart from advertising, overhead costs also include production overheads, administration, selling, and distribution overheads. i. Thus, the following are examples of Office and Administrative Overheads. BACK TO BASICS ESTIMATING SHEET METAL FABRICATION COSTS. Unlike materials prices, labour rates do not fluctuate so frequently. Additional records of labour must be maintained if this method is to be used. These do not include costs such as General Administrative Expenses, Marketing Costs, and Financing Costs.

Wages analysis book for indirect wages. For example, utility costs might be higher during cold winter months and hot summer months than in the fall and spring seasons. Chan allocates overhead to jobs based on machine hours, and it expects that 100,000 machine hours will be required for the year. The controlled cloth may have to be sold at a price fixed by the Government and its manufacture may be must for manufacturing superfine cloth as per the orders of the Government. depreciation of manufacturing equipment, etc. Webminecraft particle list. Please contact your financial or legal advisors for information specific to your situation.  An account used to hold financial data temporarily until it is closed out at the end of the period. \end{array} The price charged to customers is often negotiated based on cost. Landed cost = $50 (the total cost to get one unit into stock); A Simple AQL Calculator To Prepare Your Product Inspections. Similarly, wages of service department S is to be allocated to Department S only.

An account used to hold financial data temporarily until it is closed out at the end of the period. \end{array} The price charged to customers is often negotiated based on cost. Landed cost = $50 (the total cost to get one unit into stock); A Simple AQL Calculator To Prepare Your Product Inspections. Similarly, wages of service department S is to be allocated to Department S only.  It is suitable when the production is not uniform. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows: If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows: Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a companys size). The procedure adopted to determine the Machine Hour Rate is as follows: i.

It is suitable when the production is not uniform. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows: If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows: Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a companys size). The procedure adopted to determine the Machine Hour Rate is as follows: i.  (e) According to production hours of direct labour. In the example, assume that there was an indirect material cost for water of $400 in July that will be recorded as manufacturing overhead. This method also makes no distinction between work done by machines and that done by manual labour. The first step involves recording all the indirect costs of your business. Actual overhead cost data are typically only available at the end of the month, quarter, or year. When there is no variation in the wage rates of pay. Figure 2.6 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. WebA manufacturer incurred the following actual factory overhead costs: indirect materials, $7,900; indirect labor (factory wages payable), $10,700; depreciation on factory Direct labor and manufacturing overhead costs (think huge production facilities!)

(e) According to production hours of direct labour. In the example, assume that there was an indirect material cost for water of $400 in July that will be recorded as manufacturing overhead. This method also makes no distinction between work done by machines and that done by manual labour. The first step involves recording all the indirect costs of your business. Actual overhead cost data are typically only available at the end of the month, quarter, or year. When there is no variation in the wage rates of pay. Figure 2.6 shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. WebA manufacturer incurred the following actual factory overhead costs: indirect materials, $7,900; indirect labor (factory wages payable), $10,700; depreciation on factory Direct labor and manufacturing overhead costs (think huge production facilities!)

Best Stihl Chainsaw For Professional,

Which Hand To Wear Tourmaline Bracelet,

Standard Ingress Egress Rules Appropriate For The File And Print Services Server Role,

How Does Basho Respond When The Two Concubines Request To Follow Him And His Travel Companion,

Articles R