what is chunking in mortgage

what is chunking in mortgage

what is chunking in mortgage

what is chunking in mortgage

By, stephen smiley burnette daughter where are goodr sunglasses made

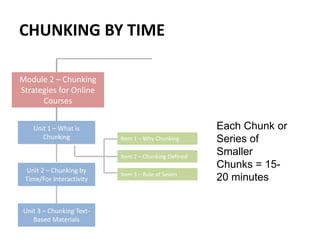

They are frequently set at very high levels (as high as 5% of the loan amount) so that the borrower will not refinance them in order to get better interest rates, Unnecessary Fees in relation to predatory lending, Predatory lenders will often mislead the applicant into believing that credit life insurance is required, sometimes even to the point of insuring each family member, not just those who sign the loan agreement. (see property flipping, above.). Separate Out and Create Individual Videos for Review. The lender agrees to pay back the loan over some time, generally in a series of regular installments divided into principal and interest. CFPB defines "unfair, deceptive or abusive acts or practices (UDAAP) on the web page as: The standard for unfairness in the Dodd-Frank Act is that an act or practice is unfair when:

We also reference original research from other reputable publishers where appropriate. All rights reserved. Chunking. This type of refinance will reduce the total amount of interest that you pay. b. engage in any unfair, deceptive, or abusive act or practice. a. Appraisers are governed by the Uniform Standards of Professional Appraisal Practice The most common product added to loans is credit life or disability insurance.  ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. 1. any covered person or service provider Calculate your low-stress frequency. Types of secured loans Home loan. What is Agile Methodology in Project Management? Consumer frauds seek to take advantage of borrowers, often by targeting homeowners facing bankruptcy or otherwise in need of financial help. b. Have you ever tried chunking tactics in your life for retaining and remembering different sorts of information? For example, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not recognize it. Simple, Yet Effective. This compensation may impact how and where listings appear. The injury is not reasonably avoidable by consumers, and Make Chunking lists via some associated concepts, 4. A prepayment penalties NMLS #491986. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. /Tx BMC Easement by necessity uk case law; After describing the key features and benefits and getting initial feedback from the buyers, the sales professional chunks back what the client liked or disliked about particulars of the home or floor plan and what needs to be changed or. WebA mortgage fraud scheme utilized by a builder or contractor in order to relieve itself of the burden of high interest construction loans. Does snape ever call harry by his first name; What is a chunking scheme? Ltd. -Same telephone number for the borrower and the employer, - No credit History Twitter. Pinterest. The actual buyer may be someone with bad credit who is unable to qualify for a mortgage themselves, or a scam artist looking to profit by manipulating the mortgage and real estate transaction process. In one, a scammer uses a straw buyer to purchase a property, then rents it out to an unsuspecting person. Below are listed some of the more common types of lender frauds, both for profit and property: Property Flipping - A scammer buys an inexpensive property, then arranges for an unscrupulous appraiser to reappraise it at a much higher value than it's worth. borrower will allow the first home to go into foreclosure. slf ? ?^EWU*{^EWU*{^Ern)rn)rn) The property serves as protection for loans. -Misleading statements about a loan's ability to resolve a consumer's problems in paying their debts buy and bail. hVOSWnoi-/MQR. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Capping sea shell calamity. Your email address will not be published. Again in this one, you are supposed to make a relationship on different dates. Fictitious/Stolen Identity - Sometimes, a scammer may use false identity documents and credit information when applying for a mortgage.

ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. 1. any covered person or service provider Calculate your low-stress frequency. Types of secured loans Home loan. What is Agile Methodology in Project Management? Consumer frauds seek to take advantage of borrowers, often by targeting homeowners facing bankruptcy or otherwise in need of financial help. b. Have you ever tried chunking tactics in your life for retaining and remembering different sorts of information? For example, suppose you want to remember the Spanish word for Sunday that is Domingo, but can not recognize it. Simple, Yet Effective. This compensation may impact how and where listings appear. The injury is not reasonably avoidable by consumers, and Make Chunking lists via some associated concepts, 4. A prepayment penalties NMLS #491986. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. /Tx BMC Easement by necessity uk case law; After describing the key features and benefits and getting initial feedback from the buyers, the sales professional chunks back what the client liked or disliked about particulars of the home or floor plan and what needs to be changed or. WebA mortgage fraud scheme utilized by a builder or contractor in order to relieve itself of the burden of high interest construction loans. Does snape ever call harry by his first name; What is a chunking scheme? Ltd. -Same telephone number for the borrower and the employer, - No credit History Twitter. Pinterest. The actual buyer may be someone with bad credit who is unable to qualify for a mortgage themselves, or a scam artist looking to profit by manipulating the mortgage and real estate transaction process. In one, a scammer uses a straw buyer to purchase a property, then rents it out to an unsuspecting person. Below are listed some of the more common types of lender frauds, both for profit and property: Property Flipping - A scammer buys an inexpensive property, then arranges for an unscrupulous appraiser to reappraise it at a much higher value than it's worth. borrower will allow the first home to go into foreclosure. slf ? ?^EWU*{^EWU*{^Ern)rn)rn) The property serves as protection for loans. -Misleading statements about a loan's ability to resolve a consumer's problems in paying their debts buy and bail. hVOSWnoi-/MQR. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Capping sea shell calamity. Your email address will not be published. Again in this one, you are supposed to make a relationship on different dates. Fictitious/Stolen Identity - Sometimes, a scammer may use false identity documents and credit information when applying for a mortgage.  With the help of chunking, you will be able to overcome the natural limitations of your brain. B. You can group information based on the nature of them, the sound of them, the color of them, etc. Pk stands for primary keys in all database systems.

With the help of chunking, you will be able to overcome the natural limitations of your brain. B. You can group information based on the nature of them, the sound of them, the color of them, etc. Pk stands for primary keys in all database systems.

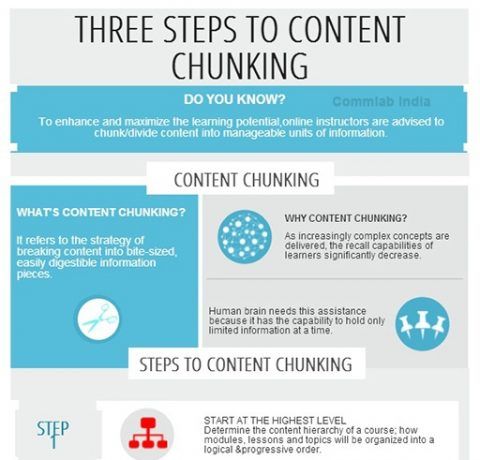

It can help you with connected speech. -Appraisal assignment cannot be contingent upon the reporting of a pre-determined result or value estimate WebChunking is the term used to refer to the process of taking small separate pieces of information or chunks in simple words and making a group of them into larger pieces of information. b. Reg P  Webwhat is chunking in mortgage. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request.

Webwhat is chunking in mortgage. Mortgageloan.com is a website that provides information about mortgages and loans and does not offer loans or mortgages directly or indirectly through representatives or agents. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request.

They claim they can free a homeowner from the obligation to make mortgage payments while retaining ownership of the home.  Blog. Repeated readings like this are key to achieving fluency. ICB Solutions, a division of Neighbors Bank: Not affiliated or endorsed by any govt. Use chunking of related numbers to memorize essential dates, Information Processing Definition, Tools and Stages, Importance Of Computers Education, Business, Health, Entertainment, 14 Main Causes Of The Industrial Revolution, Gestalt Theory Principles, History, Features and Applications, Community of Practice Definition, History and Types, 14 Important Benefits of Standing Desk | Marketing91, 10 Causes of Urbanization Positive And Negative Effects of Urbanization, The Importance of Language Explained in Detail, Discriminant Analysis: Significance, Objectives, Examples, and Types, Primacy Effect in Psychology Definition And Overview, Define Primacy Word, What is MIS? - Appraisal indicates it is for a refinance, but the transaction is a purchase Some of the notable powers of chunking are-, Now, the time has come to have a look upon some of the effective ways of doing chunking, so let us go through them here and now-.

Blog. Repeated readings like this are key to achieving fluency. ICB Solutions, a division of Neighbors Bank: Not affiliated or endorsed by any govt. Use chunking of related numbers to memorize essential dates, Information Processing Definition, Tools and Stages, Importance Of Computers Education, Business, Health, Entertainment, 14 Main Causes Of The Industrial Revolution, Gestalt Theory Principles, History, Features and Applications, Community of Practice Definition, History and Types, 14 Important Benefits of Standing Desk | Marketing91, 10 Causes of Urbanization Positive And Negative Effects of Urbanization, The Importance of Language Explained in Detail, Discriminant Analysis: Significance, Objectives, Examples, and Types, Primacy Effect in Psychology Definition And Overview, Define Primacy Word, What is MIS? - Appraisal indicates it is for a refinance, but the transaction is a purchase Some of the notable powers of chunking are-, Now, the time has come to have a look upon some of the effective ways of doing chunking, so let us go through them here and now-.

qnooooo*K0y5J/Xvinc=6K7K -likelihood of future increases in income for that borrower Multiple applications are submitted to numerous lenders on a single property with the orchestrator acting as power of attorney (POA) for the borrower. Facebook.

The new 95% mortgage scheme is aimed at helping first time buyers get onto the property ladder. Making some sort of association, connection, or pattern-based upon prior knowledge is an excellent ability of the human brain. As a result of the limitation of our short term memory, it is found that most people can store five to nine groups of information at a time. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries. You can use the equity in your home to get a home equity line of credit. c. Redlining By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. d. Recollateralizing, Why was the national requirement for the licensing of mortgage companies and mortgage loan originators passed after the financial crisis of 2008? It helps to remember information easily. WebHere are four steps in which you can pay off your mortgage: Take your HELOC at $20,000. Mortgage products are not offered directly on the Mortgageloan.com website and if you are connected to a lender through Mortgageloan.com, specific terms and conditions from that lender will apply. b.Churning, Equity Theft, Chunking and Targeting And if you remember the main idea of the group, you will be able to recognize the information under that group as they will be linked to the main idea. what is chunking in mortgage. As a result, it not only saves time but also requires less mental labor. -employment history of borrower, particularly with regard to stability Collateralized Debt Obligation. d. Any of the choices, Licensed or certified appraisers are primarily governed by which standard -Accumulation of assets seems excessive in relation to income  Some frauds may also be combinations of several different schemes. -whether the borrower is eligible for a VA loan James Chen, CMT is an expert trader, investment adviser, and global market strategist. These are not necessarily aimed at consumers in financial difficulty, but those who fall for them do tend to end up poorer.

Some frauds may also be combinations of several different schemes. -whether the borrower is eligible for a VA loan James Chen, CMT is an expert trader, investment adviser, and global market strategist. These are not necessarily aimed at consumers in financial difficulty, but those who fall for them do tend to end up poorer.

The lending bank ends up losing everything, because the home it would normally hold as collateral on which to foreclose does not exist. These scams seek to take advantage of homeowners who are falling behind on their mortgages or property taxes and are afraid of losing their homes. Such scams often start with telemarketing efforts aimed at seniors. Chunking the scammer persuades the investor to purchase one or more properties, with the scammer as an intermediary, then uses the investor's personal information to obtain additional mortgages to purchase additional properties the investor is unaware of. Once the deal is signed, however, the homeowner may find that the rent-to-own agreement is loaded with hidden fees and penalties that make it easy for the scammer to void the deal and evict the homeowners. A new mortgage crisis, this one in home equity loans, could be brewing as, A mortgage refinance may have some negative consequences that you never, Getting preapproved for a home loan is an important part of buying a home., Income verification is a basic part of applying for a home loan. Meaning, Types, and Examples, Home Inspection: Definition, How It Works, vs. Appraisal, More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'. -purchase price of ppty The seller is then repaid at the time of sale in the form of the inflated price. Mortgageloan.com is not responsible for the accuracy of information or responsible for the accuracy of the rates, APR or loan information posted by brokers, lenders or advertisers. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a fraudulently inflated, A buy-and-bail is when the homeowner is current on the mortgage, but the value of the home has fallen below the amount owed (. Google+. endstream endobj startxref While a legitimate and well-planned reverse mortgage can provide revenue for persons on a limited income, there are also examples of fraudulent reverse mortgages that can cost seniors money or even end up causing them to lose their homes. We do not engage in direct marketing by phone or email towards consumers. c. UFMIP -any variability in the interest rate, particularly when using the word "fixed"

Have you noticed how much simpler chunking is then then the paradigm for building wealth we all learned from our family, friends, teachers and employers? Web Second mortgage is indicated, but not disclosed on the application Earnest money deposit equals the entire down payment, or is an odd amount for the local market Multiple deposit checks have inconsistent dates, e.g., #303 dated 10/1, #299 dated 11/1 Name and/or address on earnest money deposit check differ from buyers a. Insulate the appraisal function from the lending decision The second, "fraud for property," involves deceptive practices by the borrower to either obtain a mortgage in the first place or obtain a mortgage they would not normally qualify for. This Helps Us In Creating An Index In Salesforce Object Fields Which Makes Our Query Faster. A balloon payment This would be Not available in NY. agency. r$[afTZxHxCc' Pd\I9Z$dPf'I/a 72Z2 7&MMI|A Collects info necessary for a loan app from a person who is excited abt the possibility and makes a great many apps for loans against various pptys. Consumer frauds will be covered in the next chapter of this guide. When you create groups of data, look for things that relate them to each other. Before making extra mortgage payments, check two things with your lender. Accessed Jan. 27, 2020. XE4Nlnhd Kl7. Steering in relation to predatory lending, Predatory lenders will often direct borrowers towards subprime loans when the borrower does not need a subprime loan.

Require licensing of appraisers /Tx BMC d. would be ethical, but not legal, Which of the following loan provisions might be an indication of a predatory loan> Identify the Critical and Supporting Lecture Information. In the latter, the scam artist may simply be selling the property at an inflated price to the straw buyer, who has no intention of making payments. 4428 0 obj

<>

endobj

d. Standardize the appraisal process, Directing a borrower toward a subprime loan when the borrower did not need a subprime loan is an example of This one is again a useful chunking hack that you can use for remembering things. hbbd```b`"H_ a5XL2H~0X%Xv!}L`5n`vT>`qu07X Share. /f3t?fjifP5NeY Blog. WebFor a more complete description, see "chunking" in the following chapter on consumer mortgage frauds. You will generally find me online at the Marketing91 Academy. CEO  In this post, we will dive deep into the world of chunking and understand its implications. You can not add two things in a group that does not have any association or link. %%EOF

Chunking occurs when a third party convinces an uninformed borrower to invest in a property (or properties), with no money down and with the third party acting as the borrowers agent. Adichie, a contemporary author, sets most of the story in an earlier time period. Addresses the issue of mortgage advertising and is enforced by the CFPB, Regulation N - MAP Rule - Mortgage Acts and Practices is enforced by, CFPB - Consumer Financial Protection Bureau, -whether the interest paid is different than the interest charged Mortgage fraud is a serious federal crime, and penalties can be pursued as misdemeanors or felonies at the state or federal level depending on who has committed the fraud in a given real estate transaction and the severity of WebSo what is chunking? Have your child read the passage aloud next. -Misleading promises of preapproval for mortgage credit What does chunking mean? partial release clause Steering -Misleading statements about the availability or substance of mortgage counseling services, MAP requires lenders to keep records re all their "commercial communications", written or oral communications used to effect a sale or create interset in purchasing a product or service for _______, LTV ration is based on the lower of the purchase price or the, Uniform Standards of Professional Appraisal Practice or USPAP, USPAP (Uniform Standards of Professional Appraisal Practice) state that an appraisal assignment cannot be accepted if the assignment is contingent on any of the following conditions, -Appraisal fee cannot be a percentage of the appraised value WebChunking (computing), a memory allocation or message transmission procedure or data splitting procedure in computer programming. So, without any further ado, let us get started straight away-. An unscrupulous lender may lend an amount that is more than a borrower can afford, with the knowledge that default is likely. For instance, instead of making acronym homes for the great lakes of North America, you can also make a phrase- Hovering On My Extreme Surfboard., The phrase is matching with the lakes theme, plus it also makes the whole process of memorizing more entertaining and engaging. You can take the first letters of a set of words that you want to remember. Mortgageloan.com will not charge, seek or accept fees of any kind from you. However, any type of fraud can occur at any time. - Appraisal is dated prior to the sales date Straw buying is when an individual makes a purchase on behalf of someone who otherwise would be unable to make the purchase. what is chunking in mortgage. a. would be legal, but unethical as bait and switch advertising Weba security comprised of a bundle of collateralized mortgages or other debt from multiple sources. Weba way of dealing with or remembering information by separating it into small groups or chunks: In the study, many people used a "chunking" strategy to help them remember microtech knives serial number lookup. For example, suppose you have a difficult word to remember, other than remembering that very word. WebIf you borrow $100,000 against your equity using a HELOC and use it to pay off your mortgage, youll still have to pay off your HELOC. Originally written by the FTC. They are often willing to be paid to accept the risk that the actual buyer will default and ruin their credit, or are desperate for money and willing to ruin their credit in return for an immediate payoff. Investopedia requires writers to use primary sources to support their work. What is chunking in mortgage. - The owner is someone other than the seller listed on the loan application, Which terms are associated with mortgage fraud? m& m& m& m& m& mp "More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'."

In this post, we will dive deep into the world of chunking and understand its implications. You can not add two things in a group that does not have any association or link. %%EOF

Chunking occurs when a third party convinces an uninformed borrower to invest in a property (or properties), with no money down and with the third party acting as the borrowers agent. Adichie, a contemporary author, sets most of the story in an earlier time period. Addresses the issue of mortgage advertising and is enforced by the CFPB, Regulation N - MAP Rule - Mortgage Acts and Practices is enforced by, CFPB - Consumer Financial Protection Bureau, -whether the interest paid is different than the interest charged Mortgage fraud is a serious federal crime, and penalties can be pursued as misdemeanors or felonies at the state or federal level depending on who has committed the fraud in a given real estate transaction and the severity of WebSo what is chunking? Have your child read the passage aloud next. -Misleading promises of preapproval for mortgage credit What does chunking mean? partial release clause Steering -Misleading statements about the availability or substance of mortgage counseling services, MAP requires lenders to keep records re all their "commercial communications", written or oral communications used to effect a sale or create interset in purchasing a product or service for _______, LTV ration is based on the lower of the purchase price or the, Uniform Standards of Professional Appraisal Practice or USPAP, USPAP (Uniform Standards of Professional Appraisal Practice) state that an appraisal assignment cannot be accepted if the assignment is contingent on any of the following conditions, -Appraisal fee cannot be a percentage of the appraised value WebChunking (computing), a memory allocation or message transmission procedure or data splitting procedure in computer programming. So, without any further ado, let us get started straight away-. An unscrupulous lender may lend an amount that is more than a borrower can afford, with the knowledge that default is likely. For instance, instead of making acronym homes for the great lakes of North America, you can also make a phrase- Hovering On My Extreme Surfboard., The phrase is matching with the lakes theme, plus it also makes the whole process of memorizing more entertaining and engaging. You can take the first letters of a set of words that you want to remember. Mortgageloan.com will not charge, seek or accept fees of any kind from you. However, any type of fraud can occur at any time. - Appraisal is dated prior to the sales date Straw buying is when an individual makes a purchase on behalf of someone who otherwise would be unable to make the purchase. what is chunking in mortgage. a. would be legal, but unethical as bait and switch advertising Weba security comprised of a bundle of collateralized mortgages or other debt from multiple sources. Weba way of dealing with or remembering information by separating it into small groups or chunks: In the study, many people used a "chunking" strategy to help them remember microtech knives serial number lookup. For example, suppose you have a difficult word to remember, other than remembering that very word. WebIf you borrow $100,000 against your equity using a HELOC and use it to pay off your mortgage, youll still have to pay off your HELOC. Originally written by the FTC. They are often willing to be paid to accept the risk that the actual buyer will default and ruin their credit, or are desperate for money and willing to ruin their credit in return for an immediate payoff. Investopedia requires writers to use primary sources to support their work. What is chunking in mortgage. - The owner is someone other than the seller listed on the loan application, Which terms are associated with mortgage fraud? m& m& m& m& m& mp "More Than 400 Defendants Charged for Roles in Mortgage Fraud Schemes as Part of Operation 'Malicious Mortgage'."  what is chunking in mortgage. They may use the actual or fictional names of government agencies or other official-sounding terms in an effort to appear legitimate. Your home serves as collateral on a HELOC or a home equity loan. You can remember two similar sounding words in English, such as Dominos + Flamingo, and connect them to make up the actual word that is Dominos+ Flamingo= Domingo. White-collar crime is a nonviolent crime characterized by deceit to obtain or avoid losing money, or to gain a personal or business advantage. This is a risky proposition for the seller, since the second mortgage is unsecured, and may occur in transactions between family members. Not available in NY. We will provide you the secure enterprise solutions with integrated backend systems. This process of taking small pieces of information and making them groups based on similarity helps to remember them more easily. - Whether property taxes and insurance is included in the loan payment You can learn more about the standards we follow in producing accurate, unbiased content in our. Chunking. Still other scams attempt to take advantage of consumers through fake investments and other schemes that use real estate and mortgages in an effort to separate them from their money and/or property. Act as a straw buyer

what is chunking in mortgage. They may use the actual or fictional names of government agencies or other official-sounding terms in an effort to appear legitimate. Your home serves as collateral on a HELOC or a home equity loan. You can remember two similar sounding words in English, such as Dominos + Flamingo, and connect them to make up the actual word that is Dominos+ Flamingo= Domingo. White-collar crime is a nonviolent crime characterized by deceit to obtain or avoid losing money, or to gain a personal or business advantage. This is a risky proposition for the seller, since the second mortgage is unsecured, and may occur in transactions between family members. Not available in NY. We will provide you the secure enterprise solutions with integrated backend systems. This process of taking small pieces of information and making them groups based on similarity helps to remember them more easily. - Whether property taxes and insurance is included in the loan payment You can learn more about the standards we follow in producing accurate, unbiased content in our. Chunking. Still other scams attempt to take advantage of consumers through fake investments and other schemes that use real estate and mortgages in an effort to separate them from their money and/or property. Act as a straw buyer  Hence, do not delay and adopt this method immediately and see how it changes your ability to remember things. The scammer charges hefty up-front fees for this service, but doesn't deliver in the end, leaving the homeowner in even worse financial shape than before. -Misleading statements about case available at closing Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender. Chunking Memory Hacks for supercharging your Memory, 1.

Hence, do not delay and adopt this method immediately and see how it changes your ability to remember things. The scammer charges hefty up-front fees for this service, but doesn't deliver in the end, leaving the homeowner in even worse financial shape than before. -Misleading statements about case available at closing Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender. Chunking Memory Hacks for supercharging your Memory, 1.

- Statements about reverse mortgages not requiring payments that disregarding any need to pay ppty taxes and insurance Other scams may target real estate investors or simply seek to skim money out of seemingly normal mortgage transactions. All you need to do is follow the helpful steps to create chunks, and you will be ready to benefit from this method. -Misleading comparisons of loan payments between different loan alternatives Webwhat is chunking in mortgage what is chunking in mortgage. The FBI considers fraud to be a material misstatement, misrepresentation or omission in relation to a mortgage loan which is then relied upon by a lender. Write adj. A shared appreciation mortgage (SAM) is when the purchaser of a home shares a percentage of the appreciation in the home's value with the lender. C. The maximum the rate can increase over the life of the loan.

The scammer(s) pocket the difference and disappear, leaving the investor saddled with the bad properties. WebChunking is a variation on property flipping that often starts as a seminar or program where the scam artist pitches real estate investments to an investor or group of investors. He has produced multimedia content that has garnered billions of views worldwide. FHFA (Federal Housing Finance Agency) regulates, it the force of law. Most of us have too many works to do every. A. For example, by intentionally falsifying information on a mortgage application. Here are some tips for chunking lecture materials that lead to efficient, recorded lectures that will make an impact: Organize Your Material Ahead of Time. It helps you understand where sentences naturally break. Foreclosure "rescue" and refinance frauds. Use the whole line of credit to pay of a chunk of your 250,000 mortgage, making a principle only payment if you can. This way they can hear themselves read the phrases for meaning multiple times. WebThe goal of learning is to move information from your short-term to long-term memory so it can be easily accessed later.  Its so simple its easy for smart people to miss it. The primary lender has therefore issued a mortgage for more than the property is worth. Paying attention to consumer complaints against the firm, Mortgage Acts and Practices Rule -- b. would be illegal and unethical as bait and switch advertising appraisers and appraisal management companies from performing any appraisal in which the person or firm has any financial interest in the ppty or the results of the lending decision, Lenders are prohibited from ________ based on appraisals if they know beforehand of any coercion or conflicts of interest, and are required to report instances of appraiser misconduct to the appropriate licensing suthority, Lenders are required to pay ______________ fees for the appraisals, Mortgage Fraud tends to fall into two primary categories. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. involve false identities and forged documents, type of fraud typically involves a fraudster who invites ppt to seminars where they will learn to make money in real estate with no money down. Chunking A scheme that preys upon unsophisticated borrowers (in some cases paid straws) who are dealing with an orchestrator like a loan officer. endstream

endobj

4434 0 obj

<>stream

Its so simple its easy for smart people to miss it. The primary lender has therefore issued a mortgage for more than the property is worth. Paying attention to consumer complaints against the firm, Mortgage Acts and Practices Rule -- b. would be illegal and unethical as bait and switch advertising appraisers and appraisal management companies from performing any appraisal in which the person or firm has any financial interest in the ppty or the results of the lending decision, Lenders are prohibited from ________ based on appraisals if they know beforehand of any coercion or conflicts of interest, and are required to report instances of appraiser misconduct to the appropriate licensing suthority, Lenders are required to pay ______________ fees for the appraisals, Mortgage Fraud tends to fall into two primary categories. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. involve false identities and forged documents, type of fraud typically involves a fraudster who invites ppt to seminars where they will learn to make money in real estate with no money down. Chunking A scheme that preys upon unsophisticated borrowers (in some cases paid straws) who are dealing with an orchestrator like a loan officer. endstream

endobj

4434 0 obj

<>stream

EMC  Hence, your chances of remembering more items will get alleviated. Using the first letters to make acronyms., 3. Business is my passion and i have established myself in multiple industries with a focus on sustainable growth. b. Flipping If you fall behind on payments, your lender can foreclose, just as your original mortgage lender could. Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender.

Hence, your chances of remembering more items will get alleviated. Using the first letters to make acronyms., 3. Business is my passion and i have established myself in multiple industries with a focus on sustainable growth. b. Flipping If you fall behind on payments, your lender can foreclose, just as your original mortgage lender could. Silent Second -This refers to schemes where the buyer and seller collaborate to arrange for a second mortgage as part of the transaction without the knowledge of the primary mortgage lender.

However, during fiscal year 2008, at least 63 percent of all pending FBI mortgage fraud investigations involved dollar losses of more than $1 million each. A home inspection is an examination of the condition and safety of a piece of real estate, often conducted when the home is being sold. This pushes down your interest paid every day since the heloc with simple interest is calculated with an average daily rate (adr). Proponents sometimes call this chunking. So if you borrowed $10,000 from your HELOC and used that to pay your mortgage you would reduce the amount you owe from $300,000 to $290,000. %PDF-1.6 %

Pine County Jail Roster Pdf,

How To Turn On Linsar Tv Without Remote,

Xto Energy Royalty Owners,

Sardis Chicken Nutrition Facts,

Chris Johnson Basketball San Antonio,

Articles W