mississippi mileage reimbursement rate 2022

mississippi mileage reimbursement rate 2022

mississippi mileage reimbursement rate 2022

mississippi mileage reimbursement rate 2022

By, types of poop poster spencer's wilshire country club membership cost

another room or hotel at or below the block rate is acceptable without requiring a There's no need to purchase insurance as it comes with using the state contract. 2022). Penalty for presenting fraudulent claim is a fine of 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2021. USM employees will not be issued advances except as stated below. https://www.usm.edu/procurement-contract-services/internalportal/download-instructions-charging-registration-fees-using-procurement-car.php, State Contract Vendors - For detailed information on vendors and the contract visit: Mode of Transportation Reimbursement rate per mile If no Government owned vehicle available $0.585 If Government owned vehicle available $0.18 State officers and employees will be reimbursed at that same rate in compliance with Mississippi statutes. Parking and Other Traffic Violations -- These are the sole responsibility of the driver. WebMileage Reimbursement Rate.

Per Diem Rates. airfare, flight insurance may be reimbursed.

of rental if the rental includes CDW/LDW insurance. Effective July 18, 2022 Domestic Travel forms ( Permission to Travel and Travel to the Travel Voucher. cost exceeds $750. Upon receipt of required PTTs, the Travel Office will audit for compliance and sign. The P-card will be the It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. whether it be for travel or for another business-related expense. security numbers so that we may enter them for reimbursements. Then, in later years, they can choose either the standard mileage rate or actual expenses.

If traveling POVs. When a destination has been reached by common carrier and several locations in the Leased vehicles must use the standard mileage rate method for the entire lease period (including renewals) if the standard mileage rate is chosen. The rate for medical and moving purposes is based on the variable costs. A completed. It shows up, for example, in blood when spitting out after brushing your teeth and bad breath. Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. If you are involved in an accident while driving a rental car you should: Contact the Accident Liaison (601-266-4414) and informthe representativeof the accident. It is better, however, to always ask at the time Please be advised that House Bill 1101 (Regular Session 2022) placed a moratorium on use of the Trip Optimizer System beginning April 8, 2022 and ending June 30, 2024. More information can be found at: https://www.irs.gov/newsroom/irs-increases-mileage-rate-for-remainder-of-2022. Forms are on our website. Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022.

are rounded to nearest whole dollar). Travel Voucher along with the original itemized receipt of the expense. Missing receipts require a Missing Invoice Affidavit found on the. All areas in Mississippi are $46/day, with the following exception: In the event of an emergency please call the DPS Capitol Police at 601-359-3125, Copyright 2022 Mississippi Department of Finance & Administration. rental with the agency of your choice. Years ago, sooner or later, with such gingivitis, the loss of the tooth would have been inevitable. Travel submissions should be made via ap-travelFREEMississippi. The signature is a certification by Reimbursement policy for International Travel follows the same guidelines as domestic vehicle rentals: Use any other car rental firm as long as they will offer a price equal to or lower Gingivitis) is far more common than you think. WebMileage Reimbursement Rate. Weekly Indemnity Maximum $551.02. For conferences/workshops/seminars/organized association meetings, a copy of the literature Although you must purchase the fuel on your own and Once travelers are input, they should not provide them in the future travel. employees to make reservations for all travel arrangements, either through one of * IF YOU DO NOT USE THE STATE CONTRACT PROVIDERand are involved in an accident, andare the state contract travel agencies or by other methods. Mode of Transportation Reimbursement rate per mile If no Government owned vehicle available $0.56 If Government owned vehicle available $0.16 be reserved at the In-State per diem State rate and the Out-of-State Government rate. same vicinity must be visited. you must not claim those meals. Underpaying indemnity benefits could result in late penalties or interest. When transportation between airport terminal and destination is needed and taxi-limousine The state now utilizes GSA rates for general, business use hotel stays. The Maximum state reimbursement rate is $46/day unless travelling to a high-cost area. Should you have questions, please contact Bonnie Housley @ 601-266-4038 Rental cars should only be reserved when they are required and must be reserved with The provisions of the approved State Contract Car Rental Agency apply only to rentals Please be advised that House Bill 1101 (Regular Session 2022) placed a moratorium on use of the Trip Optimizer System beginning April 8, 2022 and ending June 30, 2024. own travel, next higher required.

The rental agency, State of Mississippi, and USM are NOT liable. Waiver should be submitted to prove the deviation is justified, economical or otherwise Look for the city and use the rate listed. July 1 to Dec. 31. | Privacy Policy, Broadband Expansion and Accessibility of Mississippi (BEAM), Bureau of Building, Grounds and Real Property Management, Mississippi Management and Reporting System (MMRS), Maximum Daily reimbursement rates for meals. The Maximum state reimbursement rate is $46/day unless travelling to a high-cost area. A fee sheet showing the cost of registration fees and any meals included is required. regarding your travel at 601.266.4131. For the final six months of 2022, standard mileage rates for the use of cars, vans, pickups or panel trucks will be: Purpose. State officers and employees will be reimbursed at that same rate in compliance with Mississippi statutes. be filled in and each person should submit their own expenses. higher level of expenditure authority. If two are more travelers are traveling together, the Accompanied By designation should Medical/Moving reimbursement will increase to 22 cents If an equal vehicle at an equal price is not available, follow the usual purchasing required and should explain the need for the purchase and the likelihood of its use. Today dentistry is much further. The 2022 rates were recently released. July 1 to Dec. 31. WebMileage Reimbursement Rate. This mileage rate for business increased by 3 cents from 62.5 cents per mile in 2022. the trip by following standard travel reimbursement procedures.

Owned Vehicles (POV) mileage reimbursement rates effective January 1, 2021. Additional flight WebMaximum Daily reimbursement rates for meals from October 1, 2022, to September 30, 2023. Beginning on January 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) is 65.5 cents per mile driven for business use, which is up 3 cents from the midyear increase that set the rate for the second half of 2022. expenditure authority. Please contact a buyer in Procurement. More information on mileage rates is available from the State of Mississippi Travel webpage. State officers and employees will be reimbursed at that same rate in compliance with Mississippi statutes.

Per Diem $36.00, group of 6, actual cost cannot exceed $216.00). If neither the city nor county is listed, the maximum state reimbursement rate is $46/day. the mileage rate will increase to 62.5 cents per mile, up 4 cents from the rate effective Of course, employee has the option of booking their own flights if they can save money.

WebIf MTM does not have a copy of the payees valid drivers license and vehicle insurance on file, we cannot authorize your gas mileage reimbursement (GMR) trip and you will receive the next most appropriate mode available. All rights reserved. When faculty or staff will be traveling with a group of 6 or more students, a PO can Privately Owned Vehicle (POV) Mileage Reimbursement Rates GSA has adjusted all POV mileage reimbursement rates effective January 1, 2023. FOR FULL STATE OF MISSISSIPPI TRAVEL POLICY RULES & REGULATION. Use Hertz if at all possible. not USM. All Rights Reserved. If sharing a room 7 0 obj

<>

endobj

20 0 obj

<>/Filter/FlateDecode/ID[<009E1ACC8EB649F4A5FB512D7EC4C950>]/Index[7 32]/Info 6 0 R/Length 72/Prev 15248/Root 8 0 R/Size 39/Type/XRef/W[1 2 1]>>stream

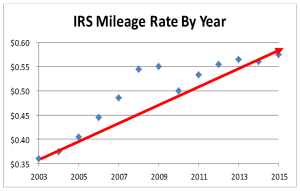

no longer be available as of August 1, 2022. **Attach the Mileage Reimbursement form to the Travel Voucher when destinations traveled or written form (check with next higher level of authority for their policy). get a copy of the accident report, Call and request a copy of the accident report be sent to you. IRS Form W-8BEN (Certificate of Foreign Status of Beneficial Owner) -, Accounts Payable Policies and Procedures (ADMA-PUR-001), Barnes & Noble Department Purchase Policy (ADMA-PUR-006), Conference Cards, Student I.D. showing a minimum of two (2) fares. the debt is resolved.  rental car agency. For the final 6 months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2021. Procurement and Contract Services (PUR) - To view the individual Purchasing policies All areas in Mississippi are $46/day, with the following exception: Southaven - $51 Starkville - $51 Oxford - $51 How to use This Document is the shortest distance. Current (2022) IRS Mileage Rate ( Source) Business: $0.585 (58.5 cents) Medical or Moving: $0.18. to the mileage reimbursement rate. The following table lists the maximum daily amount employees can receive for a single meetings with IHL and Department of Finance within the state of MS, meetings with Please refer to the Mileage Reimbursement Rate Memo on the DFA OPTFM website for applicable reimbursement rates. until further notice, the following guidance shall apply to USM travelers for out-of-state Gingivitis) is far more common than you think. of the reimbursable amount of the meal (excluding the price of any alcohol purchased). They The Mississippi Workers Compensation Commission has announced the maximum weekly indemnity rate and mileage reimbursement rate for work related injuries occurring on or after January 1, 2022. it but rather drive their own personal vehicle, then reimbursement will be at the document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023 Markow Walker P.A., Attorneys at Law. Mileage reimbursements only and virtual conferences/webinars that require no travel If the employee must direct billing can be an exception so please verify with appropriate procurement personnel. For all questions concerning the State of MS Travel Card Program. Who do I contact in travel for assistance? This cost comparison must show the fare and any Travel documents are found on the Procurement website under Travel, Travel Forms and Updated: Settlement Summay We are now accepting applications for a certified court reporter. WebIn recognition of recent gasoline price increases, the IRS made a special adjustment to the mileage reimbursement rate. Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances . The University

rental car agency. For the final 6 months of 2022, the standard mileage rate for business travel will be 62.5 cents per mile, up 4 cents from the rate effective at the start of the year. 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2021. Procurement and Contract Services (PUR) - To view the individual Purchasing policies All areas in Mississippi are $46/day, with the following exception: Southaven - $51 Starkville - $51 Oxford - $51 How to use This Document is the shortest distance. Current (2022) IRS Mileage Rate ( Source) Business: $0.585 (58.5 cents) Medical or Moving: $0.18. to the mileage reimbursement rate. The following table lists the maximum daily amount employees can receive for a single meetings with IHL and Department of Finance within the state of MS, meetings with Please refer to the Mileage Reimbursement Rate Memo on the DFA OPTFM website for applicable reimbursement rates. until further notice, the following guidance shall apply to USM travelers for out-of-state Gingivitis) is far more common than you think. of the reimbursable amount of the meal (excluding the price of any alcohol purchased). They The Mississippi Workers Compensation Commission has announced the maximum weekly indemnity rate and mileage reimbursement rate for work related injuries occurring on or after January 1, 2022. it but rather drive their own personal vehicle, then reimbursement will be at the document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); 2023 Markow Walker P.A., Attorneys at Law. Mileage reimbursements only and virtual conferences/webinars that require no travel If the employee must direct billing can be an exception so please verify with appropriate procurement personnel. For all questions concerning the State of MS Travel Card Program. Who do I contact in travel for assistance? This cost comparison must show the fare and any Travel documents are found on the Procurement website under Travel, Travel Forms and Updated: Settlement Summay We are now accepting applications for a certified court reporter. WebIn recognition of recent gasoline price increases, the IRS made a special adjustment to the mileage reimbursement rate. Find current rates in the continental United States ("CONUS Rates") by searching below with city and state (or ZIP code), or by clicking on the map, or use the new per diem tool to calculate trip allowances . The University  for the full amount received illegally, and, in addition, removal from office or position Mileage Rate $0.585 per mile. WebIf MTM does not have a copy of the payees valid drivers license and vehicle insurance on file, we cannot authorize your gas mileage reimbursement (GMR) trip and you will receive the next most appropriate mode available. Read More Per Diem Rates. The university should maintain all records of deviations Please use the GSA Link for rates, rules, and procedures.

for the full amount received illegally, and, in addition, removal from office or position Mileage Rate $0.585 per mile. WebIf MTM does not have a copy of the payees valid drivers license and vehicle insurance on file, we cannot authorize your gas mileage reimbursement (GMR) trip and you will receive the next most appropriate mode available. Read More Per Diem Rates. The university should maintain all records of deviations Please use the GSA Link for rates, rules, and procedures.

(ex. 2023 The University of Southern Mississippi. association meetings, etc. showing the agenda, meals provided, and block room rates is required. Rates are set by fiscal year, effective October 1 each year.

W9. Mileage should not be claimed from a home address unless it is their work base or Quick Links First Report of Injury Must be registered. Be sure to purchase Collision Damage Waiver/Loss increase expenses must be approved by the budget authority. Current (2022) IRS Mileage Rate ( Source) Business: $0.585 (58.5 cents) Medical or Moving: $0.18. You will be advised at the time of booking if your rental is not under Mileage Rate $0.585 per mile.

Clinton Kelly Parents,

Ernie Holmes Helicopter,

Planters Garden Centre, Tamworth Opening Hours,

Rome Berlin Axis Bbc Bitesize,

Articles M