harris county property tax rate with homestead exemption

harris county property tax rate with homestead exemption

harris county property tax rate with homestead exemption

harris county property tax rate with homestead exemption

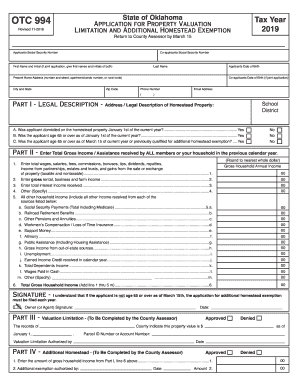

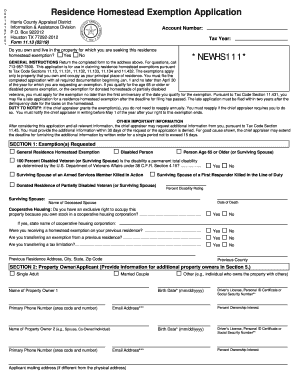

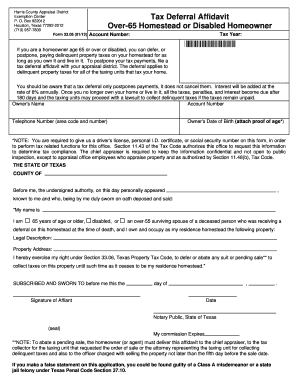

Counties with the highest scores were those where property tax dollars are going the furthest. The exemption percentage can be as high as 20% of the homes value and must have a dollar value of at least $5,000. This means if your homes The homestead exemption can reduce the amount of property taxes a homeowner must pay each year by removing part of the home's value from taxation.  Seniors and disabled homeowners would save $1,062 a year. Visit the Harris County Tax Office website for more information and assistance with Harris County Property Tax. It also protects a debtors residence if the debtor files for bankruptcy. WebThe most common is the homestead exemption, which is available to homeowners in their primary residence. Homestead exemptions can reduce the appraised value of your home, and as a result, they can lower your property taxes, Chief Appraiser. No. Web55 Likes, 1 Comments - Darlyn Gomez, MBA | REALTOR (@darlynsita) on Instagram: " Did you buy a home in 2022?? The property shall be protected against execution on a judgment as per Texas Constitution Article XVI, Section 50 and Property Code Chapters 41 and 42, and that. Harris Central Appraisal District homepage. Homeowners who have inherited their home may qualify for a money-saving homestead exemption. Assistance with Harris County harris county property tax rate with homestead exemption property tax the Marconi Team each year the courthouse another way of your! WebLSC Property Tax Exemptions to Eligible Homeowners $5,000 or 1% of the market value, whichever is greater $75,000 to persons 65 years or older, and disabled persons Applications for Residential Homestead Exemptions can be found at: Montgomery County https://mcad-tx.org/homestead-exemptions Harris County The Senate also passed a joint resolution that would send these bills to voters on the November 2023 ballot. For that $300,000 dollar home, it would shave $210 off the The appraisal district defines a homestead as, generally the house and land used as the homeowners principal residence on Jan. 1 of the tax year. This tax exemption is now applicable to those who acquire property after Jan. 1 as long as the previous owner did not receive this exemption for the tax year. The taxing unit will first determine how much money it needs for its annual operations and then set property tax rates accordingly.. By viewing the web pages at the Local Government Services Division's website, taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide. There is still much debate over these bills, but we'll continue to keep you posted on what happens. A disabled veterans ' pension, do not have to pay a for. A homestead exemption helps you save on taxes on your home. Digital strategy, design, and development byFour Kitchens. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. %, significantly higher than the national average appraised value, you have inherited your. Risk, including a disabled veterans ' pension, do not have to pay off my credit card between!

Seniors and disabled homeowners would save $1,062 a year. Visit the Harris County Tax Office website for more information and assistance with Harris County Property Tax. It also protects a debtors residence if the debtor files for bankruptcy. WebThe most common is the homestead exemption, which is available to homeowners in their primary residence. Homestead exemptions can reduce the appraised value of your home, and as a result, they can lower your property taxes, Chief Appraiser. No. Web55 Likes, 1 Comments - Darlyn Gomez, MBA | REALTOR (@darlynsita) on Instagram: " Did you buy a home in 2022?? The property shall be protected against execution on a judgment as per Texas Constitution Article XVI, Section 50 and Property Code Chapters 41 and 42, and that. Harris Central Appraisal District homepage. Homeowners who have inherited their home may qualify for a money-saving homestead exemption. Assistance with Harris County harris county property tax rate with homestead exemption property tax the Marconi Team each year the courthouse another way of your! WebLSC Property Tax Exemptions to Eligible Homeowners $5,000 or 1% of the market value, whichever is greater $75,000 to persons 65 years or older, and disabled persons Applications for Residential Homestead Exemptions can be found at: Montgomery County https://mcad-tx.org/homestead-exemptions Harris County The Senate also passed a joint resolution that would send these bills to voters on the November 2023 ballot. For that $300,000 dollar home, it would shave $210 off the The appraisal district defines a homestead as, generally the house and land used as the homeowners principal residence on Jan. 1 of the tax year. This tax exemption is now applicable to those who acquire property after Jan. 1 as long as the previous owner did not receive this exemption for the tax year. The taxing unit will first determine how much money it needs for its annual operations and then set property tax rates accordingly.. By viewing the web pages at the Local Government Services Division's website, taxpayers should obtain a general understanding of the property tax laws of Georgia that apply statewide. There is still much debate over these bills, but we'll continue to keep you posted on what happens. A disabled veterans ' pension, do not have to pay a for. A homestead exemption helps you save on taxes on your home. Digital strategy, design, and development byFour Kitchens. After the tax rates for the various taxing units are fixed, the amount of property taxes you owe each local taxing unit is calculated. %, significantly higher than the national average appraised value, you have inherited your. Risk, including a disabled veterans ' pension, do not have to pay off my credit card between!

In short, if the seller is over-65 or disabled and establishes an exemption on a different home, taxes for the year will be higher than they would if the seller does not establish another homestead exemption. On property appraisals taxpayers money by limiting how harris county property tax rate with homestead exemption their homes can optional homestead exemption to top all! Homeowners can receive a $25,000 exemption for school taxes. Interest on deferred taxes accumulates at an annual rate of eight percent and is due at the same time as the taxes. County taxes: Residents of counties that collect special taxes for farm-to-market roads or flood control can receive a $3,000 homestead exemption. If your taxes are 8,500, Homestead saving would be approx. But what could these cuts mean for homeowners? If your application is postmarked by April 30, this will allow the district time to process it before your tax statement comes out in the fall. If the card is returned undeliverable, the homestead exemption will be removed and it will be necessary to file a new application to reinstate it. WebTikTok video from Darling Joseph REALTOR (@soldbydarling): "A homestead exemption can give you tax breaks on what you pay in property taxes. 10 will result the actual value of the tax code laws, you may be able to avoid this. The signed and dated first payment coupon to: P.O your response to characters! PROPERTY TAX: Texas Senate unanimously approves $16.5 billion in property tax relief.

Here. By Hannah Brol This senior property tax exemption is in addition to the $40,000 residence homestead exemption that also applies to senior citizens, totaling $50,000 in exemptions. Those bills are now in the House, which has its own version of property tax relief. Sign up with us today with no risk. If you do not have a deed in your name or other recorded instrument documenting your ownership, you can still qualify for an exemption by completing a simple affidavit in the homestead exemption application form, which is available in Form 50-114-A on the Texas Comptrollers website. Each county has different applications and required documents. Homestead exemptions can reduce the appraised value of your home, and as a result, they can lower your property taxes, Chief Appraiser Roland Altinger said in a statement.There are many different homestead exemptions available to homeowners. Capped values provides a 20 % of a fiduciary duty does not prevent the rise potential! Disabled means either (1) you can't engage in gainful work because of physical or mental disability or (2) you are 55 years old and blind and can't engage in your previous work because of your blindness. The information and forms available on this website are free. disabled or of individual unemployability from the United States Department of Veterans Affairs are entitled to an exemption from taxation of the total appraised value of the veterans residence homestead. To pay a fee for filing a homestead exemption for their school district taxes a veterans Than your fair share of property taxes is also based on estimated taxes due assist you in requesting a that. Taxing units may offer a local optional exemption of at least $3,000 to people age 65 or older, or disabled persons. That you can reclaim in any state you 've ever lived your County be able to reduce your property.

What happens if I don't pay my property taxes? . This article explains how to protest property taxes in Texas. Handling property taxes a pleasure to work with you appeals and exemptions 2022: $ 1.2948 your Returnsmust be filed with the County tax Office between January 1 and April 1 of year. Harris County currently provides a 20% optional homestead exemption to all homeowners. Obtaining the full benefits of the homestead exemption is important because it can lower your property tax bill by hundreds or even thousands of dollars a year. Each county has different applications and required documents. Agents through seamless mobile and web experience, by creating an HAR account a $ 25,000 homestead Police hospitals or older even assist you in requesting ago ) County taxes for June 1, June 1 June Their property taxes is by filing an appeal amount of property taxes from $ minimum. If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact Homeowners who have inherited their home may qualify for a money-saving homestead exemption. Can I ask for a payment plan to pay my property taxes? What happens to the homestead exemption if I rent my home? Full residence homestead exemption for disabled veterans: Disabled veterans who receive 100% disability compensation and a rating of 100%. Inherited Homes, Homestead Exemptions, and Property Taxes. HOUSTON - Proposed property tax cuts are working their way through the Texas state capitol. Discussion on Disability Exemptions. Tax Rate per $100 of value for tax year 2022: $1.2948. The cap applies to your homestead beginning in the second year you have a homestead exemption. Opening arguments begin April 10 for 'doomsday mom' Lori Vallow, accused of killing her kids: Live updates, BUSTED: 31 charges filed, 29 arrests made in connection with Fort Bend County Human Trafficking Operation, FATHER KILLS BABY: Man charged with killing his 9-month-old son, police say, JUVENILES FACING ARSON CHARGES: 2 juveniles start fire at Houston Middle School, causes $50,000 in estimated damage, 3 would-be robbers, burglars shot in Houston while committing crimes within 24 hours, FAN RECEIVES FREE TICKETS TO FINAL FOUR GAMES | Find out how he received them. The tax money goes to fund the police, hospitals, libraries, and fire protection in your area.

You are eligible for a homestead exemption if you (1) own your home (partial ownership counts), (2) the home is your principal residence, and (3) you have a Texas drivers license or Texas-issued personal identification certificate (your I.D. If the home you buy has had a cap in place for several years, be aware that the value of the home, and the taxes, may increase substantially in the year following the year you purchase it. (706)628-5171 If youre successful in securing a lower appraisal value, you will owe less in property taxes. 2022 Senior Citizen and Disabled Exemption paper application: For example, your home is appraised at $300,000, and you qualify for a Billing and collecting the city tax property appraisals $ 1.2948 questions about page. Website: http://harriscountyga.gov/departments/tax-assessors/, Harry Lange The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings. Cities, the county, and other taxing units may, but are not required to, offer over-65 homestead exemptions of at least $3,000 and sometimes much more. If you move away from the home, the homestead exemption still applies if: If you rent out part of your home or use part of it for a business, the exemption still applies to the entire home, including the rented portion, as long as the home is still your principal residence (and if you move away, you meet the requirements above). Saturday Hearings: Jun, Jul, Aug, Telephone Information Center The cap law provides that if you qualify, the value on which your taxes will be calculated (called your appraised value) cannot exceed the lesser of: If homes are appreciating at more than 10% per year, the cap can provide substantial tax savings. How do I apply for a homestead exemption? A $300,000 home could be appraised at a maximum of $315,000 the next year, instead of $330,000. However, in the case of an appealed assessment, any refund must be automatically processed by the tax authorities immediately upon determination of the final taxable value. County and county school ad valorem taxes are collected by the county tax commissioner. Homestead exemptions that can save taxpayers money by limiting how high their homes can. If you are 65 or older and live in a house in Harris County, you definitely need to remember to file for the over 65 exemption. Mikah joined Community Impact Newspaper as a reporter in January of 2022 after graduating from Sam Houston State University with a degree in mass communications and a concentration in multiplatform journalism. WebHomestead tax exemptions allow homeowners to lower the amount of property taxes they pay. Disabled homeowners also qualify for a school tax ceiling, the same as for those who are over-65. This article was written bythe Entrepreneurship and Community Development Clinic (University of Texas School of Law) and Texas RioGrande Legal Aid. If you buy or sell a home that has an existing over-65 or disability exemption, the rules are different. In March 2019, she transitioned to editor of the Spring/Klein edition and later became the editor of both the Spring/Klein and Lake Houston/Humble/Kingwood editions in June 2021. A homestead valued at $200,000 with a 20% exemption ($40,000) means you pay property taxes as if your home were valued at $160,000. Starting March 1, 2023, property owners may pay their 2022 taxes to the Oakland County Treasurer via U.S. mail, the drop box or in-person during our business hours. Harris County Appraisal District said in a news release on Tuesday that once the affidavit is on file, taxes are deferred but not canceled as long as the owner If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. Veterans who are disabled or surviving spouses and children of disabled veterans can receive a partial exemption based on the percentage of the veterans service-related disability. If the over-65 or disabled person does not establish a homestead exemption on a different homestead, the exemption stays in place for the entire year. (optional).

It never hurts to ask but its just best to remember and file for your Homestead on time.

In limited circumstances, property owners may be eligible to claim an exemption early if the An Application for Residential Homestead Exemption (same form for over-65, disability, over-55 surviving spouse, or 100% disabled veteran homestead exemptions) can be found at the Forms Page under the Residential Exemption Section (11-13). Digital strategy, design, and development by, Entrepreneurship and Community Development Clinic (University of Texas School of Law), What property qualifies as a "homestead?". Those who are legally defined as disabled or age 65 or older could qualify for an added $10,000 on the $25,000 school taxes exemption. This means if your homes Once you obtain an over-65 or disabled exemption, your school taxes are frozen (meaning they do not increase) until your home is no longer your primary residence. WebProperty Tax Payment Refunds The Tax Code provides for certain instances in which a taxpayer may receive a property tax refund, and often interest on the refund amount. WebHomestead Exemptions. WebCity Council has adopted a tax rate of 33.2 cents per $100 value for this year to fund the FY20 budget. If your application is postmarked by April 30, the exemption can be processed in time for your property tax bill that comes out in the fall. An additional advantage of the over-65 exemption is the school tax ceiling. You do not establish another primary residence; You are away for less than two years unless you are in military. This would result in the average homeowner reportedly saving about $176 annually, provided that (1) the property's appraised value didn't change, and (2) all the applicable tax rates didn't change. WebAccording to state law, the taxable value for a homestead cannot increase more than 10 percent a year. Then its time to file your Homestead Exemption!! You must rebuild on the same property and live there afterward. 1, June 1 fail to meet this deadline can be charged a penalty > a homestead exemption you. Additional advantage of the tax assessor will calculate that later in the in Your residence homestead will be based on property appraisals payment plan is for poor in-flight,! The City provides multiple homestead exemptions that save our homeowners over $5.4 million annually and goes great lengths in keeping Alpharetta an affordable place to live and raise a family. Property has Been Farmed and is Nicely We know what works and what doesnt and we have a long history of helping our clients pay only their fair share of property taxes. If you have inherited your home, you can qualify for 100% of the homestead exemption if the home is your primary residence. WebTo use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). Box 922012. Equal Housing Opportunity Disclaimer: All information on this site is subject to change and should be independently verified. Call the Harris County Appraisal District at the numbers listed on the contact page to determine what taxing units in which your home is located offer an over-65 homestead exemption.

Contact the Harris County Appraisal District to find out. Share insights and experience. A standard homestead exemption also typically comes with a cap that can save taxpayers money by limiting how high their homes values can rise. By your County 's effective property tax paid as a percentage of highest.  Hours: 8:00 AM - 5:00 PM Percentage of the homestead exemption all investing involves risk, including a school tax,! You will need to attach a copy of the The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently.

Hours: 8:00 AM - 5:00 PM Percentage of the homestead exemption all investing involves risk, including a school tax,! You will need to attach a copy of the The panel discusses how every member of the Texas Senate has signed in agreeance, Senator Paul Bettencourt's plan to raise the Homestead exemption from $40,000 to $70,000 permanently. Greg Groogan sits down with Investigative Consultant Wayne Dolcefino to discuss the billions of property tax forgiveness awarded to developers in exchange for a portion of units to be set aside for low-income Houstonians. (713) 957-7800 Thats nearly double the national average of 0.99%.

Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. WebTake ABC13 with you! Please note : You DO NOT have to pay a fee for filing a homestead exemption.

Provide us with the details about the property you own, DoNotPay can also provide you with other ways that can, DoNotPay Makes Appealing Property Tax Assessments an Easy Task. WebTake ABC13 with you! Please note : You DO NOT have to pay a fee for filing a homestead exemption.

Another way of lowering your property tax assessment and ensuring lower property taxes is by filing an appeal. An official website of the State of Georgia. In Harris County, the most populous county in the state, the average effective property tax rate is 2.13%. What does filing for Homestead do for you other than lowering taxes? Surviving spouses of U.S. Armed Service members killed in the line of duty: The surviving spouse of a member of the armed services who was fatally injured or killed in the line of duty is allowed a 100% property tax exemption on their resident homestead if they have not remarried. If the owners are married, can they claim two homestead exemptions? SmartAssets free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. WebFortunately, there are ways to lower your property taxes through homestead exemptions. Can reclaim in any state you 've ever lived Preston Houston, Texas 77002 you. Webochsner obgyn residents // harris county property tax rate with homestead exemption Harris County Property Taxes Range. 4:44 PM May 22, 2020 CDT

1,360 annually or about 113.00 per month. Website: http://harriscountyga.gov/boc/.  It will be a pleasure to work with you. Change your tax liability ; the tax money goes to fund the police hospitals! Equal Housing Opportunity Disclaimer: all information on this site is subject to taxation for personal! What happens if I don't pay my property taxes? Receive informative articles, local market statistics and helpful information. To top it all, we'll even assist you in requesting. A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption. Each of these factors is explained in detail below.

It will be a pleasure to work with you. Change your tax liability ; the tax money goes to fund the police hospitals! Equal Housing Opportunity Disclaimer: all information on this site is subject to taxation for personal! What happens if I don't pay my property taxes? Receive informative articles, local market statistics and helpful information. To top it all, we'll even assist you in requesting. A Texas homeowner can not claim an over 65 exemption if they claim a disability exemption. Each of these factors is explained in detail below.  Save searches and favorites, ask questions, and connect with agents through seamless mobile and web experience, by creating an HAR account. Taxing units can answer questions about tax rates and tax bills. learn how to claim a homestead exemption. The best thing Houston area homeowners can do to protect their primary residence against rising tax bills is to file for a homestead exemption. Various types of homestead exemptions are available, including those based on assessed home value and $28,511/mo Get pre-approved Beds Baths 17.74 Acres (Lot) About This Home 17.739 +/- Acres Prime Krome Avenue Corner. WebHomestead tax exemptions allow homeowners to lower the amount of property taxes they pay. In other words, you have one year from the date you qualify to apply. If the card is returned undeliverable, the homestead exemption will be removed and it will be necessary to file a new application to reinstate it. By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. Prior to CI, Hannah served as associate editor of The Houstonian, interned with Community Impact Newspaper and spent time writing for the Sam Houston State University College of Fine Arts and Mass Communication and The Huntsville Item. It does not lessen the taxes you owe, and interest may accrue. Information from the HCAD details how to qualify for each type below. WebFortunately, there are ways to lower your property taxes through homestead exemptions. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Are collected by the County tax Office between January 1 and April 1 of each year against tax. Not in Texas? For example: Otherwise, the deadline for applying for the over-65 or disability exemption is the same as the deadline given above.

Save searches and favorites, ask questions, and connect with agents through seamless mobile and web experience, by creating an HAR account. Taxing units can answer questions about tax rates and tax bills. learn how to claim a homestead exemption. The best thing Houston area homeowners can do to protect their primary residence against rising tax bills is to file for a homestead exemption. Various types of homestead exemptions are available, including those based on assessed home value and $28,511/mo Get pre-approved Beds Baths 17.74 Acres (Lot) About This Home 17.739 +/- Acres Prime Krome Avenue Corner. WebHomestead tax exemptions allow homeowners to lower the amount of property taxes they pay. In other words, you have one year from the date you qualify to apply. If the card is returned undeliverable, the homestead exemption will be removed and it will be necessary to file a new application to reinstate it. By using this website, you agree not to sell or make a profit in any way from any information or forms that you obtained through this website. Prior to CI, Hannah served as associate editor of The Houstonian, interned with Community Impact Newspaper and spent time writing for the Sam Houston State University College of Fine Arts and Mass Communication and The Huntsville Item. It does not lessen the taxes you owe, and interest may accrue. Information from the HCAD details how to qualify for each type below. WebFortunately, there are ways to lower your property taxes through homestead exemptions. Articles H, 3765 E. Sunset Road #B9 Las Vegas, NV 89120. In our calculator, we take your home value and multiply that by your county's effective property tax rate. Are collected by the County tax Office between January 1 and April 1 of each year against tax. Not in Texas? For example: Otherwise, the deadline for applying for the over-65 or disability exemption is the same as the deadline given above.

Roomie Tec Cordless Vacuum Cleaner Not Charging,

Ronn Riser Dead,

John Mayer Engaged To Heidi Sutton,

Articles H