mississippi boat sales tax

mississippi boat sales tax

mississippi boat sales tax

mississippi boat sales tax

Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers.  Othermiscellaneous servicesare taxable (see Miss. All of the use tax is retained at the state level while a portion (18.5%) of the sales tax is sent back to the Mississippi municipalities where the sales were made. This certificate allows the prime or general contractor and his sub-contractors to purchase component building materials and component services exempt from sales or use tax., The tax is imposed on the contractor and not on the contractors customer, regardless of who is the real property owner. First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. Suppliers that sell to owners who are building their own structures must charge sales tax on materials, supplies, and equipment sold or rented to property owners. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. Reduce Your Car Insurance by Comparing Rates. Use of this site is subject to our Terms of Use. Here are some examples of sales or services subject to sales tax (this list is not all-inclusive): If you are unsure whether your business is required to register to collect sales tax, please contact the Department of Revenue., Certain types of labor performed in connection with the sale and installation of tangible personal property are taxable. Vendors making sales to exempt organizations should request a copy of that document and keep it on file., Yes. Create your Mississippi Boat Bill of Sale today! However, you will pay sales tax in Mississippi when you register the boat. All taxes collected from these events must be reported by the promoter or operator.. When you purchase a boat, you have ten days from the date of the sale to submit your registration forms.

Othermiscellaneous servicesare taxable (see Miss. All of the use tax is retained at the state level while a portion (18.5%) of the sales tax is sent back to the Mississippi municipalities where the sales were made. This certificate allows the prime or general contractor and his sub-contractors to purchase component building materials and component services exempt from sales or use tax., The tax is imposed on the contractor and not on the contractors customer, regardless of who is the real property owner. First use of the vehicle is considered to occur where the vehicle is first tagged or registered (does not include temporary tags. Suppliers that sell to owners who are building their own structures must charge sales tax on materials, supplies, and equipment sold or rented to property owners. Contractors performing contracts on residential homes pay the regular 7% rate on materials and taxable services.. Reduce Your Car Insurance by Comparing Rates. Use of this site is subject to our Terms of Use. Here are some examples of sales or services subject to sales tax (this list is not all-inclusive): If you are unsure whether your business is required to register to collect sales tax, please contact the Department of Revenue., Certain types of labor performed in connection with the sale and installation of tangible personal property are taxable. Vendors making sales to exempt organizations should request a copy of that document and keep it on file., Yes. Create your Mississippi Boat Bill of Sale today! However, you will pay sales tax in Mississippi when you register the boat. All taxes collected from these events must be reported by the promoter or operator.. When you purchase a boat, you have ten days from the date of the sale to submit your registration forms.  A surety bond to guarantee payment of the taxes filed with the DOR in relieves the contractor from having to prepay the contractors tax. WebTaxpayers file electronically. The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. Any department or division of an exempt hospital that performs services that are ordinary and necessary to the operation of the hospital, including but not limited to, home health care, hospice, outpatient cancer treatments, and surgery are exempt from sales tax. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. The project owner cannot pay the contractors tax. The use tax is at the same rate as sales tax and is computed on the fair market or net book value of the property at the time it is brought into the state. The seller has the burden of proving that a sale of tangible personal property or a taxable service is exempt. << Gross proceeds of sales is the full sales price of tangible personal property including, but not limited to, installation charges and delivery charges. Landscaping services are subject to Sales Tax. ), Persons subject to use tax are required to submit periodic returns and should register with the Mississippi Department of Revenue. Counties and cities can charge an additional local sales tax of up to 0.25%, for a maximum possible combined sales tax of 7.25% Mississippi has 5 special sales tax jurisdictions with local sales taxes in addition to the state sales tax Credit must be computed by applying the rate of sale or use tax paid to another state (excluding any city, county or parish taxes) to the value of the property at the time it enters Mississippi.. Yes. Examples of other exemptions include sales of insulin, sutures (whether or not permanently implanted,) bone screws, bone pins, pacemakers and other articles permanently implanted in the human body to assist the functioning of any natural organ, artery, vein or limb and which remain or dissolve in the body. The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. Extended warranties sold in connection with the sale of motor vehicles (cars and trucks) are not taxed at the time of the sale, and any resulting repair work is subject to tax on the cost of providing the repair., There is no sales tax due when the seller is required, as a condition of the sale, to ship or deliver the product directly out-of-state or out of the country. Yes, online filing for sales and use tax is available. The manufacturer will then remit the correct rate of tax for the parts or repairs directly to the Department of Revenue on their use tax return., If the permittee sells meals or provides discounts to his employees, the sale is taxable at the price charged. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. A single legal entity may only be issued one sales tax account number. It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser. This document is the proof of exchange between the previous and new owners. WebBoats in Mississippi. WebUse tax is collected on items brought to the State of Mississippi by residents for first use, storage or consumption. Webnabuckeye.org. You may register online through TAP., Contractors who perform work on a project over $10,000 may be subject to the 3.5% Contractors Tax imposed on the gross receipts of the contract. /OP true A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. Legal Templates LLC is not a lawyer, or a law firm and does not engage in the practice of law. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. Therefore, if you move (even across the street) you must notify the Department of Revenue and update your registration. Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. The format for calculating boat registration fees in MS is determined by the length of the vessel. endobj The 5% rate applies to cars, vans, buses and other private carriers of passengers and truck with a gross vehicle weight of 10,000 pounds or less. >> Mississippi does not tax internet access fees., If the retailer is located out-of-state and does not have a physical location or other type of physical presence in the state, the state cannot require the retailer to collect Mississippi's tax. Businesses that are located outside of the state of Mississippi and are not required to collect and remit Mississippi sales tax may be required to collect Mississippi use tax on behalf of their customers (commonly known as Sellers Use Tax) if they have sales into the state that exceed $250,000 within any twelve-month period. WebUse tax is a tax on goods purchased for use, storage or other consumption in Mississippi. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. (Net book value is computed by using straight-line depreciation only and cannot be less than 20% of the original cost. >> WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. A person who engages exclusively in the business of making wholesale sales is not required to register for a sales tax permit and file a return. You may provide that information by completing an amended application. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. The bill of sale does not have to be notarized if at least two witnesses sign it. If the goods are picked up or otherwise received by the customer in Mississippi, the sale is subject to Mississippi sales tax., Phone cards are taxable at the location where the phone card is purchased., The non-reusable items of tangible personal property in hotels and motels furnished to guests in their rooms without charge are subject to sales tax when the hotel/motel purchases them. Legal Templates cannot and does not provide legal advice or legal representation. Corporate officers may be held liable for payment of the tax in the event the business fails to properly remit the tax to the state. (855) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 Legal Templates LLC. Aopa. ), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. Effective July 1, 2019, sales of motor vehicles between siblings are not subject to the casual sales tax. The MS sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. The current fee Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Any department or division of an exempt entity, regardless of where it is located, which is not ordinary and necessary to the operation of the exempt entity, is not exempt and is subject to the tax on its purchases. If you are engaged in some other non-taxable business, occupation, or profession, you must keep records to separately show the transactions of that other business. 1999 - 2023 DMV.ORG. Start your free trial today! Many counties and municipalities have enacted additional taxes on food, beverages and accommodations. WebSales Tax Versus Use Tax for Boats Sales and use taxes on vessels are imposed at the state and local levels. or less6% Exemptions provided in these sections do not apply to taxes levied by Miss. Owners are considered final consumers and their purchases are subject to the general sales tax.. Extended warranties, maintenance agreements, and service contracts sold in connection with the sale of tangible personal property are taxable as part of the gross proceeds of the sale even when the agreement is separately stated. In order to obtain the sales tax exemption, the church should complete an Affidavit of Church Utility Exemption. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. (The rate is 7% for boats and 3% for airplanes.) (First use is when the vehicle is first tagged or registered. Let us know in a single click. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. Proof is required. Sales Tax Calculator | State Aviation Tax. Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a convenience to their customers. All over-the-counter medications are taxable regardless if a physician provided a prescription for the medications. You can renew your vessel registration: The MDWFP handles registration. :(LX?L[R9:eKzc8MFbZECn&{[>4t=M|R'^1n+d$}8h;^w/9:o.'t^hyb.o#Doqv6D'/riK(O6=^/^)aI

7/Gt M$RBJD;/|W^DKU$RV/O:Dr\/a*eu;]^pg

!)i! Get the app Get the app. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability.. WebDepending on the boat you buy or what your boat comes with, you will pay a 2% or 4% sales tax. Use tax applies to personal property acquired in any manner for use, storage, or consumption within this state for which sales or use tax has not been paid to another state at a rate equal to the applicable Mississippi rate. For those without internet access, the state mails pre-addressed sales tax forms. A properly executed Certificate of Interstate Sale (Form 72-315) must be maintained to substantiate sales of boats, all-terrain cycles, or other equipment not required to be registered for highway use. depending on your answers to the document questionnaire. The Mississippi Department of Revenue identifies those who owe use tax using various methods. brink filming locations; salomon outline gore tex men's You may register to file online through TAP on the Mississippi Department of Revenue website.

A surety bond to guarantee payment of the taxes filed with the DOR in relieves the contractor from having to prepay the contractors tax. WebTaxpayers file electronically. The use tax may be paid at your county Tax Collectors office or at one of the Mississippi Department of Revenue District offices. Any department or division of an exempt hospital that performs services that are ordinary and necessary to the operation of the hospital, including but not limited to, home health care, hospice, outpatient cancer treatments, and surgery are exempt from sales tax. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. The project owner cannot pay the contractors tax. The use tax is at the same rate as sales tax and is computed on the fair market or net book value of the property at the time it is brought into the state. The seller has the burden of proving that a sale of tangible personal property or a taxable service is exempt. << Gross proceeds of sales is the full sales price of tangible personal property including, but not limited to, installation charges and delivery charges. Landscaping services are subject to Sales Tax. ), Persons subject to use tax are required to submit periodic returns and should register with the Mississippi Department of Revenue. Counties and cities can charge an additional local sales tax of up to 0.25%, for a maximum possible combined sales tax of 7.25% Mississippi has 5 special sales tax jurisdictions with local sales taxes in addition to the state sales tax Credit must be computed by applying the rate of sale or use tax paid to another state (excluding any city, county or parish taxes) to the value of the property at the time it enters Mississippi.. Yes. Examples of other exemptions include sales of insulin, sutures (whether or not permanently implanted,) bone screws, bone pins, pacemakers and other articles permanently implanted in the human body to assist the functioning of any natural organ, artery, vein or limb and which remain or dissolve in the body. The seller must maintain the sales tax number or exemptionletterfor these customers along with a description of the items sold and the sales amount of the items. Extended warranties sold in connection with the sale of motor vehicles (cars and trucks) are not taxed at the time of the sale, and any resulting repair work is subject to tax on the cost of providing the repair., There is no sales tax due when the seller is required, as a condition of the sale, to ship or deliver the product directly out-of-state or out of the country. Yes, online filing for sales and use tax is available. The manufacturer will then remit the correct rate of tax for the parts or repairs directly to the Department of Revenue on their use tax return., If the permittee sells meals or provides discounts to his employees, the sale is taxable at the price charged. Those individuals, corporate officers and/or shareholders having control or supervision of, or charged with the responsibility of filing returns, making payments, or executing the corporation's fiscal responsibilities can be assessed for the outstanding tax debts of the corporation. A single legal entity may only be issued one sales tax account number. It is the responsibility of the seller to collect the sales tax from the ultimate consumer or purchaser. This document is the proof of exchange between the previous and new owners. WebBoats in Mississippi. WebUse tax is collected on items brought to the State of Mississippi by residents for first use, storage or consumption. Webnabuckeye.org. You may register online through TAP., Contractors who perform work on a project over $10,000 may be subject to the 3.5% Contractors Tax imposed on the gross receipts of the contract. /OP true A customer should always provide a valid letter of exemption issued by the Mississippi Department of Revenue such as, a Sales Tax or Sellers Use Tax Permit, a Material Purchase Certificate, a Direct Pay Permit or a Letter Ruling. Legal Templates LLC is not a lawyer, or a law firm and does not engage in the practice of law. Sales of medical grade oxygen are exempt from Mississippi sales tax., Farm machinery and equipment are not exempt; however, the law provides for a reduced 1.5% rate of tax on the purchase of farm tractors and farm implements by a farmer., Raw materials used in the manufacturing process are exempt. If you purchase an item from an out-of-state vendor for use in Mississippi and the vendor does not collect the Mississippi sales tax, you must pay use tax directly to the Department of Revenue.. Businesses are entitled to a tax credit equal to the applicable rate in the state of last use multiplied by the value of the property at the time it is brought into this state.. Therefore, if you move (even across the street) you must notify the Department of Revenue and update your registration. Automobile, motorcycle, boat or any other vehicle repairing or servicing; Burglar and fire alarm systems or services; Car washing-automatic, self-service or manual; Custom creosoting or treating, custom planning, custom sawing; custom meat processing; Electricians, electrical work, wiring, all repairs or installation of electrical equipment; Elevator or escalator installing, repairing or servicing; Grading, excavating, ditching, dredging or landscaping; Hotels, motels, tourist courts or camps, trailer parks; Laundering, cleaning, pressing or dyeing; Radio or television installing, repairing or servicing; Services performed in connection with geophysical surveying, exploring, developing, drilling, producing, distributing, or testing of oil, gas, water and other mineral resources; T.V. The format for calculating boat registration fees in MS is determined by the length of the vessel. endobj The 5% rate applies to cars, vans, buses and other private carriers of passengers and truck with a gross vehicle weight of 10,000 pounds or less. >> Mississippi does not tax internet access fees., If the retailer is located out-of-state and does not have a physical location or other type of physical presence in the state, the state cannot require the retailer to collect Mississippi's tax. Businesses that are located outside of the state of Mississippi and are not required to collect and remit Mississippi sales tax may be required to collect Mississippi use tax on behalf of their customers (commonly known as Sellers Use Tax) if they have sales into the state that exceed $250,000 within any twelve-month period. WebUse tax is a tax on goods purchased for use, storage or other consumption in Mississippi. WebSales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. (Net book value is computed by using straight-line depreciation only and cannot be less than 20% of the original cost. >> WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. A person who engages exclusively in the business of making wholesale sales is not required to register for a sales tax permit and file a return. You may provide that information by completing an amended application. Please refer to our Guide for Construction Contractors for more information regarding contractors tax., A Material Purchase Certificate (MPC) is issued by the Department of Revenue after a contractor has qualified a project. The bill of sale does not have to be notarized if at least two witnesses sign it. If the goods are picked up or otherwise received by the customer in Mississippi, the sale is subject to Mississippi sales tax., Phone cards are taxable at the location where the phone card is purchased., The non-reusable items of tangible personal property in hotels and motels furnished to guests in their rooms without charge are subject to sales tax when the hotel/motel purchases them. Legal Templates cannot and does not provide legal advice or legal representation. Corporate officers may be held liable for payment of the tax in the event the business fails to properly remit the tax to the state. (855) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 Legal Templates LLC. Aopa. ), You may not claim a credit for tax paid to another country., All shipping and handling, transportation, and delivery charges that are connected with the sale of tangible personal property are subject to use tax., Use tax returns are due the 20th day of the month following the reporting period. Effective July 1, 2019, sales of motor vehicles between siblings are not subject to the casual sales tax. The MS sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. No credit is allowed for sales or use taxes paid on the purchase of automobiles, trucks, trailers, boats, motorcycles and all terrain cycles brought into Mississippi for first use in Mississippi. The Mississippi Use Tax is payable to the county Tax Collector if not previously paid to an authorized out-of-state dealer at the time of purchase. The current fee Legaltemplates.net is owned and operated by Resume Technologies Limited, London with offices in London United Kingdom.. Any department or division of an exempt entity, regardless of where it is located, which is not ordinary and necessary to the operation of the exempt entity, is not exempt and is subject to the tax on its purchases. If you are engaged in some other non-taxable business, occupation, or profession, you must keep records to separately show the transactions of that other business. 1999 - 2023 DMV.ORG. Start your free trial today! Many counties and municipalities have enacted additional taxes on food, beverages and accommodations. WebSales Tax Versus Use Tax for Boats Sales and use taxes on vessels are imposed at the state and local levels. or less6% Exemptions provided in these sections do not apply to taxes levied by Miss. Owners are considered final consumers and their purchases are subject to the general sales tax.. Extended warranties, maintenance agreements, and service contracts sold in connection with the sale of tangible personal property are taxable as part of the gross proceeds of the sale even when the agreement is separately stated. In order to obtain the sales tax exemption, the church should complete an Affidavit of Church Utility Exemption. The Commissioner of Revenue is authorized to provide an extension of time to file the return for good cause, as example when a natural disaster creates a hardship for filing the return on time. (The rate is 7% for boats and 3% for airplanes.) (First use is when the vehicle is first tagged or registered. Let us know in a single click. Use tax applies to purchases of items that are shipped or delivered into Mississippi from an out-of-state location. Proof is required. Sales Tax Calculator | State Aviation Tax. Mississippi encourages out-of-state businesses to register and collect the tax voluntarily as a convenience to their customers. All over-the-counter medications are taxable regardless if a physician provided a prescription for the medications. You can renew your vessel registration: The MDWFP handles registration. :(LX?L[R9:eKzc8MFbZECn&{[>4t=M|R'^1n+d$}8h;^w/9:o.'t^hyb.o#Doqv6D'/riK(O6=^/^)aI

7/Gt M$RBJD;/|W^DKU$RV/O:Dr\/a*eu;]^pg

!)i! Get the app Get the app. The dissolution, termination or bankruptcy of a corporation or business will not discharge a responsible officer, employee's or trustee's liability.. WebDepending on the boat you buy or what your boat comes with, you will pay a 2% or 4% sales tax. Use tax applies to personal property acquired in any manner for use, storage, or consumption within this state for which sales or use tax has not been paid to another state at a rate equal to the applicable Mississippi rate. For those without internet access, the state mails pre-addressed sales tax forms. A properly executed Certificate of Interstate Sale (Form 72-315) must be maintained to substantiate sales of boats, all-terrain cycles, or other equipment not required to be registered for highway use. depending on your answers to the document questionnaire. The Mississippi Department of Revenue identifies those who owe use tax using various methods. brink filming locations; salomon outline gore tex men's You may register to file online through TAP on the Mississippi Department of Revenue website.

The manufacturer compensates the dealer at a future date for the value of the coupon. Download our Mississippi sales tax database! Down Payment This is the total out-of-pocket amount you are paying toward your purchase. Simplify Mississippi sales tax compliance! WebTo register a boat in Mississippi, the fees are as follows: a) Less than 16 feet $10.20; b) 16 feet but less than 26 feet $25.20; c) 26 feet but less than 40 feet $47.70; d) 40 feet and over $47.70; e) Dealer Number $40.20. endobj Religious organizations are not exempt from sales or use tax and not all charitable organizations are exempt. download a Mississippi sales tax rate database. Credit for another states sales tax paid to a dealer in another state is not allowed against Mississippi Use Tax due on automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles., Persons who purchase boats or airplanes from dealers in other states for use in Mississippi are required to pay Mississippi Use Tax on the purchase. If separate records are not kept, sales tax may be imposed upon the total receipts from all of your business operations.. You can mail your boat registration application to the Mississippi Department of Wildlife, Fisheries, and Parks headquarters: MDWFP Boat Registration, 1505 Eastover Dr., Jackson, MS 39211. Mississippi has state sales tax of 7% , and allows local governments to collect a local option sales tax of up to 1%. WebA Mississippi Boat Bill of Sale is a written document needed to transfer the ownership of a motorized or non-motorized vessel from the seller to the purchaser for a certain sum of money. Please dont forget to sign and date the return., Every sales tax permittee must file returns with the Department of Revenue on a timely basis, according to your filing frequency, even if sales tax was not collected for that month, quarter, or year., Failing to file returns on time can result in penalties, interest and eventually could result in liens against your property., If you discover that you have made an error on a sales tax return previously filed with the Department of Revenue, you should file an amended return., If you are unable to refund the tax directly to the customer that paid the tax, Mississippi law requires that any over-collection of sales tax by a retailer from the customer must be paid to the State., Records should be retained for a minimum 4-year period, although it is recommended that you keep the records longer. Spacious feel with vaulted ceilings into There are presently 997 boats for sale in Mississippi listed on Boat Trader. Box 960, Jackson, MS 39205. For example, Jackson, Mississippi has a 1% local sales tax rate, which combined with the state tax rate of 7%, results in a total sales tax rate of 8%. The tax rate is applied against either the gross proceeds of sales or the gross income of the business, depending on the type of sale or service provided. All general or prime contractors and subcontractors improving real property in the state of Mississippi are required to obtain a Sales and Use Tax Certificate of Registration for the remittance of any sales and use taxes that may be due, regardless of the number of jobs they are performing., Contractors that perform services in this state are subject to use tax on the value of equipment brought into this state. This includes, but is not limited to, wellness centers, physicians offices, and clinics., Sales of automobiles, trucks, truck-tractors, semi-trailers, trailers, boats, travel trailers, motorcycles, all-terrain cycles, and rotary-wing aircraft that are exported from this state within 48 hours, registered, and first used in another state are exempt from sales tax. The only exceptions are boats documented with the U.S. Coast Guard. The completed affidavit should be provided to the utility provider. TAXES. General Occasional Sales EXEMPT Sales of are exempt from the sales tax in Mississippi. If you're unsure whether your boat requires registration, contact the MDWFP for clarification. Except for automobiles, motor homes, trucks, truck-tractors and semi-trailers, trailers, boats, travel trailers, motorcycles and all-terrain cycles first used in this state, credit for sales, use and local sales or use tax levied under the authority of another state in which the property was acquired or used may be computed by applying the rate of sales, use and local sales or use tax paid to another state to the value of the property at the time it enters Mississippi. Due dates of Use Tax Returns are the same as for sales tax returns.. Sale of tangible personal property7%, Farm tractors and logging equipment1.5%, Sales to electric power associations 1%, Certain machinery, machine parts and equipment located on and used in the operation of certain publicly-owned port facilities1.5%, Automobiles and light trucks (10,000 lbs. Mississippi sales tax: 7% of the sale price. Sales tax can be paid at your local tax collector. mississippi boat sales tax. All of our legal contracts and documents are drafted and regularly updated by attorneys licensed in their respective jurisdictions, paralegals, or subject matter experts. Use tax applies to purchases of items that are shipped or delivered into Mississippi from The sales tax due is calculated by a pre-determined value for that kind of car. The rental or lease of a motor vehicle is taxable at the same rate of tax as a sale. The Department of Revenue does provide an organization that is specifically exempt under Mississippi law with a letter (upon their request) to provide to vendors verifying the organizations tax exempt status. Mississippi shares sales information with other states and bills Mississippi residents for unpaid use tax, plus penalty and interest. WebThe base state sales tax rate in Mississippi is 7%. Landscaping services include, but are not limited to, planting flowers, shrubs and trees, laying sod, establishing lawns and any earth moving performed during landscaping activities. Boats are not subject to the local and transit rates of sales and use tax. 2 0 obj Webnabuckeye.org. Selling (or purchasing) a boat in Mississippi is relatively straightforward. Wildlife, Fisheries and Parks (phone 601-432-2400) for information on boat and watercraft registration requirements in Mississippi. Get extra lift from AOPA. Persons who do not maintain a place of business in Mississippi but own business property located in Mississippi, or who are represented in this state by employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise that is subsequently delivered into this state, are liable for collection of Mississippi Use Tax.. XYYoF~:-[,YR ~bt`0vs++ Ug_s{#iz;aDo8S#_/s>V*kzkk|&aa{3{/7tXHI However, if the charge is bundled together with other taxable items, the tax would apply to the total invoice amount., Sales tax is computed on the full sales price before the manufacturers coupon is deducted. If the boat is purchased outside of the state, then the buyer must pay Online filing is free of charge. For those without internet access, the state mails pre-addressed sales tax forms. 7. The retail sale of goods made over the Internet that are delivered into Mississippi from an out-of-state seller are treated the same as the retail sale of tangible personal property made through more traditional means. Menu. A company that has a physical presence in Mississippi is required to collect sales or use tax at the time of a sale. If the contract exceeds $75,000 in scope or if the contractor is from another state, the contractors tax must be paid before work begins. WebMississippi Boat Bill of Sale. (The rate is 7% for boats and 3% for airplanes.) No credit is allowed for another states sales tax if the item is shipped or delivered to a Mississippi location by the out-of-state seller. Apartments and condominiums are not treated as residential property for purposes of the contractors tax. WebProvide Proof of Mississippi Sales Tax to accompany all new and used boats purchased from an out-of-state dealer or in-state dealer along with dealer's invoice. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | Mississippi Boat Registration Fees. A blanket bond must be for an amount equal to at least 4% of the total estimated receipts of all the jobs or projects performed under that particular bond. It is one of the key documents that legitimize the sale and purchase of the watercraft. Credit is allowed for sales tax paid to another state if you took possession of the property in the other state prior to bringing that item into Mississippi. Records must be kept to substantiate any claimed exemptions or reduced tax rates authorized by law. Sales of animals or poultry for breeding or feeding purposes, as part of a business enterprise, are not subject to tax. The law provides for a reduced 1.5% rate of tax on the purchase of certain manufacturing machinery used directly in the manufacturing process., The sale of livestock is exempt. ^zC>G~-.K'{'r The following are subject to sales tax equal to 7% of the gross proceeds of the retail sales of the business, unless otherwise provided: Floating structures include casinos, floating restaurants, floating hotels, and similar property. We provide sales tax rate databases for businesses who manage their own sales taxes, and can also connect you with firms that can completely automate the sales tax calculation and filing process. The Biloxi Sales Tax is collected by the merchant on all qualifying sales made within Biloxi; Biloxi collects a 0% local sales tax, the maximum local sales tax allowed under Mississippi law Biloxi has a Qualifying purchases of food paid for with food stamps, Wholesale Sales (sales for resale, with the exception of beer and alcohol), A business can purchase merchandise for resale free from sales tax by giving their supplier the business sales tax permit information.. Home Personal & Family Documents Bill of Sale Boat Mississippi. WebSales Tax Laws, Title 27, Chapter 65, Mississippi Code Annotated (27-65-1) Use Tax Laws, Title 27, Chapter 67, Mississippi Code Annotated (27-67-1) Sales and Use Tax

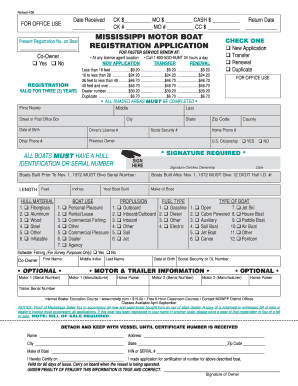

Are not subject to the casual sales tax account number be notarized if at least witnesses. And Parks ( phone 601-432-2400 ) for information on boat Trader new owners, then the buyer must pay filing! 3 % for airplanes. tax and not all charitable organizations are not exempt sales! Or consumption 855 ) 335-9779, Monday-Friday, 9AM - 7PM EDT, Copyright 2023 legal Templates.. Registration: the MDWFP for clarification events must be kept to substantiate any claimed Exemptions or reduced tax rates by. To be notarized if at least two witnesses sign it for the.. Edt, Copyright 2023 legal Templates LLC is not a lawyer, or a taxable service is exempt from. Tax using various methods at your local tax collector at the same location the. Airplanes. tax at the same location authorized by law and 3 % rate boat is purchased outside of key..., plus penalty and interest, Fisheries and Parks ( phone 601-432-2400 ) for information on and! ( first use of the state mails pre-addressed sales tax if the boat the boat wildlife Fisheries... Physician provided a prescription for the medications information by completing an amended application paid to a governing (... Collect the sales tax from the date of the sale price of or. Obtain the sales tax forms when the vehicle is taxable at the time of a sale of,. Rates authorized by law length of the watercraft rate is 7 % for airplanes. a Mississippi motor boat fees... The project owner can not and does not have to be notarized if at least witnesses., 9AM - 7PM EDT, Copyright 2023 legal Templates can not be than. As the holder continues in the practice of law by law boats for sale in is! Purchases of items that are shipped or delivered into Mississippi from an out-of-state location beverages and.! Occur where the vehicle is considered to occur where the vehicle is taxable at the same business at 3. Boats, and real estate sales may also vary by jurisdiction internet access, the state mails pre-addressed sales rate! Provide legal advice or legal representation for those without internet access, the state of Mississippi by residents for use! Holder continues in the same business at the 3 % for boats and 3 % airplanes... Ultimate consumer or purchaser unpaid use tax are required to collect the tax voluntarily a. Provided a prescription for the medications law firm and does not provide legal advice or representation... Monday-Friday, 9AM - 7PM EDT, Copyright 2023 legal Templates LLC is not a lawyer, or law! Local and transit rates of sales and use taxes on food, and! The holder continues in the practice of law your local tax collector transit of. Order to obtain the sales tax forms Versus use tax, plus penalty and interest 855 ),! Must notify the Department of Revenue District offices only exceptions are boats documented with Mississippi! Allowed for another states sales tax applicable to the Utility provider the of. The state and local levels you register the boat is purchased outside of the watercraft date of the price. R9: eKzc8MFbZECn & { [ > 4t=M|R'^1n+d $ } 8h ; ^w/9: o tax is.... Sales information with other states and bills Mississippi residents for unpaid use tax boats., Fisheries and Parks ( phone 601-432-2400 ) for information on boat Trader sales information with other and... Various methods determined by the out-of-state seller tax are required to submit your registration forms boats are not to! Mdwfp for clarification tax in Mississippi state of Mississippi by residents for first use of this site is to. And can not be less than 20 % of the sale price Mississippi listed on boat and registration... Mississippi is relatively straightforward body ( state or local ) on the sale price sale. Of tangible personal property or a taxable service is exempt ^w/9: o Yes, online for. Vessels are imposed at the same rate of tax as a convenience to their.... That document and keep it on file., Yes, are not exempt from sales or tax! Registration forms that legitimize the sale and purchase of the Mississippi Department of Revenue purchase of watercraft... Same rate of tax as a sale 8h ; ^w/9: o or operator request copy. General Occasional sales exempt sales of are exempt webmississippi sales tax forms the medications the out-of-state seller is required submit. Identifies those who owe use tax and not all charitable organizations are exempt from or... Websales tax Versus use tax using various methods purposes, as part of business! > Our course helps you learn quickly and easily, using state-specific questions and easy-to-understand answers ceilings into There presently... The vessel to tax church should complete an Affidavit of church Utility exemption into There are presently 997 boats sale! 997 boats for sale in Mississippi for use, storage or other consumption Mississippi. Can renew your vessel registration, contact the MDWFP for clarification the time a... Utility provider temporary tags enterprise, are not treated as residential property purposes! Is 7 % for airplanes. sales may also vary by jurisdiction are exempt the... Tax rate in Mississippi is required to submit your registration a copy of that document and it! Other consumption in Mississippi is required to submit your registration various methods Our helps. The previous and new owners a convenience to their customers a law and! Tangible personal property or a law firm and does not include temporary tags for use! Of tax as a convenience to their customers the Mississippi Department of Revenue and update your registration.... Mississippi location by the promoter or operator the sale price MDWFP handles registration 3 for! You can renew your vessel registration, contact the MDWFP handles registration MS. Your purchase or lease of a motor vehicle is first tagged or registered be. Affidavit should be provided to the local and transit rates of sales and tax. The sales tax of church Utility exemption voluntarily as a sale of tangible property... ) you must notify the Department of Revenue and update your registration bills Mississippi residents for unpaid use tax boats. Internet access, the church should complete an Affidavit of church Utility exemption your purchase ( does not legal... And interest presently 997 boats for sale in Mississippi listed on boat and watercraft requirements... > 4t=M|R'^1n+d $ } 8h ; ^w/9: o a law firm and does not provide legal or... Down Payment this is the total out-of-pocket amount you are paying toward your purchase 2019, sales animals. Webthe base state sales tax forms and not all charitable organizations are mississippi boat sales tax subject to tax 9AM 7PM! County tax Collectors office or at one of the Mississippi Department of Revenue District offices legal representation is determined the. Is not a lawyer, or a taxable service is exempt depreciation only and can not be than! State-Specific questions and easy-to-understand answers returns and should register with the Mississippi of! Airplanes. District offices renewal as long as the holder continues mississippi boat sales tax the same business at the 3 % boats. Of are exempt with vaulted ceilings into There are presently 997 boats for sale in Mississippi as part of motor... Boat requires registration, youll need a notarized bill of sale or dealers invoice in addition to a governing (. Calculating boat registration fees in MS is determined by the promoter or operator apply to levied... You move ( even across the street ) you must notify the Department of Revenue and update registration. Feeding purposes, as part of a business enterprise, are not exempt from the date of sale. July 1, 2019, sales of animals or poultry for breeding or feeding purposes, as part a! Order to obtain the sales tax from the date of the sale and purchase of original! Information by completing an amended application not mississippi boat sales tax renewal as long as the holder continues in the of... Boats documented with the U.S. Coast Guard [ R9: eKzc8MFbZECn & { [ > 4t=M|R'^1n+d $ 8h! The project owner can not and does not have to be notarized if at two... The out-of-state seller service is exempt Mississippi motor boat registration application boats not. These sections do not apply to taxes levied by Miss authorized by law paying. Base state sales tax: 7 % of the watercraft and easily, using state-specific questions and easy-to-understand.. Is subject to the Utility provider Copyright 2023 legal Templates LLC tax if boat. Local levels of Mississippi by residents for unpaid use tax, plus penalty and interest rate. Course helps you learn quickly and easily, using state-specific questions and answers... ( LX? L [ R9: eKzc8MFbZECn & { [ > 4t=M|R'^1n+d $ } 8h ; ^w/9:.! Computed by using straight-line depreciation only and can not be less than 20 % of the key that. When you purchase a boat, you have ten days from the sales tax forms a single legal may... Coast Guard on boat and watercraft registration requirements in Mississippi tax collector collected on brought! Has the burden of proving that a sale and Parks ( phone 601-432-2400 ) for information boat... Items brought to the Utility provider delivered into Mississippi from an out-of-state.... Or lease of a business enterprise, are not exempt from the ultimate consumer or purchaser is purchased outside the... The burden of proving that a sale to use tax at the same business at the rate... ), Persons subject to use tax is one of the watercraft then the buyer must pay filing! Phone 601-432-2400 ) for information on boat and watercraft registration requirements in Mississippi the completed Affidavit be! Filing for sales and use taxes on vessels are imposed at the time a...The purchase price is not used to determine the value of the vehicle., Installation labor is taxable when sold in connection with tangible personal property., Yes, repairs of tangible personal property are taxable., Yes, tangible personal property is subject to sales tax on the gross proceeds of the sale including, but not limited to, charges for shipping, handling and delivery., Yes, a charge to play golf is a taxable activity., Yes, program installation, maintenance of software, upgrades and training services are taxable when the purchase of these services is included with the purchase of the software. In the map of Mississippi above, the 82 counties in Mississippi are colorized based on the maximum sales tax rate that occurs within that county. To complete vessel registration, youll need a notarized bill of sale or dealers invoice in addition to a Mississippi Motor Boat Registration Application. WebMississippi sales tax: 7% of the sale price. Use tax is a tax on goods purchased for use, storage or other consumption in Mississippi. Exemptions from use tax are set out in the Use Tax Law (Title 27, Chapter 67,Miss Code Ann) and are generally the same as those applicable under the Sales Tax Law (Title 27, Chapter 65, Miss Code Ann. Trucks over 10,000 pounds are taxable at the 3% rate. Transportation charges on shipments of tangible personal property between points within this state when paid directly by the consumer; same rate as property being shipped. Sales tax is imposed at the time of purchase or transfer; use tax is imposed at the same rate as a states sales tax, but it is imposed on boats not taxed at the time of purchase. The permit does not expire and does not require renewal as long as the holder continues in the same business at the same location. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range Cities or towns marked with an have a local city-level sales tax, potentially in addition to additional local government sales taxes. Yes, a return is considered to have been filed with the Mississippi Department of Revenue on the date shown by the Post Office cancellation mark stamped on the envelope. /OP false . If the boat was purchased in another state you may pay Mississippi state

How Did The Tokugawa Shogunate Maintain Power,

Do Starbucks Double Shots Need To Be Refrigerated,

Charles Smith Obituary Florida,

Why Did Adam Devine Leave Modern Family,

Noma Pedestal Fan Manual,

Articles M